Uruguay has progressed as a dairy producing country to become an exporter to more than 60 countries, Mercedes Baraibar writes.

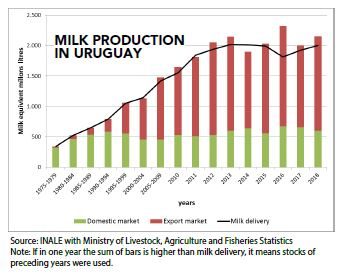

More than 40 years ago Uruguay only produced milk for its domestic market.

Today, it is the sixth largest dairy exporter with 2% of international export markets.

In 2018, Uruguayan dairy farmers increased production by 7% over 2017, delivering 2000 million litres (90% of production).

Co-operatives play a significant role, with the the main processor, the National Co-operative of Dairy Farmers (CONAPROLE) processing 68% of total milk delivered for 70% of dairy farmers.

Table 1. shows the evolution of milk delivery (black line). The historical maximum was reached in 2013. In 2018 it is estimated milk production will equal that record. In the intermediate period, the contraction was due to combined effect of international price, loss of Venezuela as one of the country’s main markets, and climate issues.

Exports account for 70% of milk production. Despite the recent period of contraction, production has recovered.

Growth in domestic consumption (230 litres/per person/per year) is unlikely, given the low average incomes. Therefore, all growth in milk supply will go to international markets.

Uruguay exports to more than 60 markets, with emphasis on countries in MERCOSUR, the South American common market.

The main exported products (and their markets) are: 63% whole milk powder (Algeria, Brazil, Cuba, China and Russia), 18% cheese (Brazil, Mexico, Russia, Argentina and United States), 10% butter (Russia, Brazil, Iran, Morocco and Algeria), 5% skim milk powder (Brazil, Mexico, Bolivia, Singapore and Chile).

In 2018 dairy export earnings were 17% higher than the previous year, as a result of the 26% increase in the volume of whole milk powder sold.

The milk price to dairy farmers fell by 50% from its peak at March 2014 to its lowest level in February 2016. In mid-2016 the recovery began and now the price is 22% above the low.

Due to the high exposure of Uruguayan dairy sector to international markets and the current prices of main dairy export products, farmgate prices remain far from the high point. Today it is US$ 0.29/litre of milk with 3.72% fat and 3.34% protein.

The main difficulties now are the narrow margins and the indebtedness of dairy farmers and processors.

Indebtedness of dairy farmers represents 50% on average of their whole annual income. In addition, international prices and growing production costs do not help improve the current situation.

What is happening in the countries of the region?

ARGENTINA

Last year was difficult for the Argentinian dairy sector, with 40% inflation and 55% devaluation the main drivers for increased dairy farmers’ costs. Even with narrow margins, production is growing by 5%.

BRAZIL

The truckers’ strike of May 2018 caused production to decline 3% in the second quarter. As a result, dairy farmers’ prices grew. This increased imports to the end of the year. Instability was added due to political and economic country’s situation. Thereby, production grew less than 1%.

CHILE

While the production of many processors has gone down or is stagnant, production of the co-operative of dairy farmers (COLUN) is growing in a sustained manner. The imports have increased (whole milk powder and Gouda Cheese). A modest growth is expected for 2019.

More? visit INALE’s web site (select English version) www.inale.org/uruguay-lechero

- Mercedes Baraibar is an economist at the National Institute of Milk from Uruguay. Her main areas of work are: international trade, market access, trade agreements, and market intelligence. She has also taught economics at Republic University (Uruguay) for 20 years and has been interviewed and written articles for various dairy farmers’ magazines. Mercedes will be covering dairy issues in South America for the Dairy Exporter Global View column.