Farm consultant Chris Lewis from Baker Ag, Wairarapa says it’s time for an open and frank discussion on the way forward in the new banking era. Using an industry standard data base and a pressure test typical of that used by banks to review their clients he says the results are confronting. He offers some suggestions for what comes next but the Dairy Exporter and Chris want to hear from bankers, farmers and those in the industry. Is the pressure test too tough, is the business of New Zealand dairy farming at more risk than we realise or is there another answer?

At BakerAg we have become very much aware of the changing criteria for finance. This is in response to the Reserve Bank and the expectation that farmers engage in regular principal repayment. In turn the trading banks have established new criteria for funding.

Please don’t skip reading this article because you think this only applies to new funding or new clients. This is being applied to all farm debt. BakerAg believe up to two thirds of New Zealand dairy farmers will be impacted.

Changing terms will at the very least be a request for sustained interest and principal (I&P) repayment but for those farms deemed to be unable to deliver on this, there could be the expectation of re-structuring the business such that it can meet these criteria. Worst case… “sell down of assets”.

The bank is making a judgement call on your ability to repay debt based on a pressure test. This constitutes a set of assumptions around milk price and interest rate over a series of consecutive seasons, where your business needs to maintain sufficient liquidity to fully deliver I&P requirements.

Further to this you are expected to fully maintain the business. So; farm maintenance, fertiliser and capital expenditure are not cost-cutting avenues in tough years to save money.

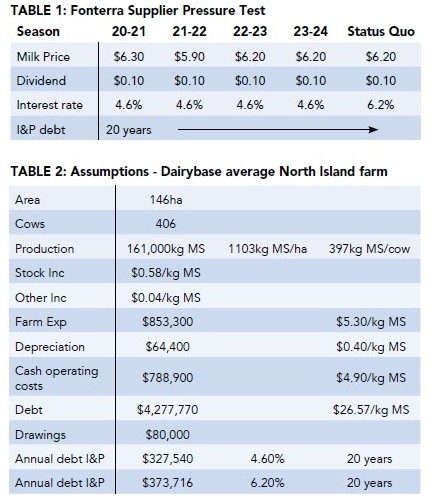

Purely as an example this pressure test criteria might look like Table 1 for a Fonterra supplier.

At BakerAg we thought “let’s apply this to an industry benchmark”. In the following example we use the pressure test criteria on the North Island Dairybase benchmark average farm, 2018-2019 season. (Table 2).

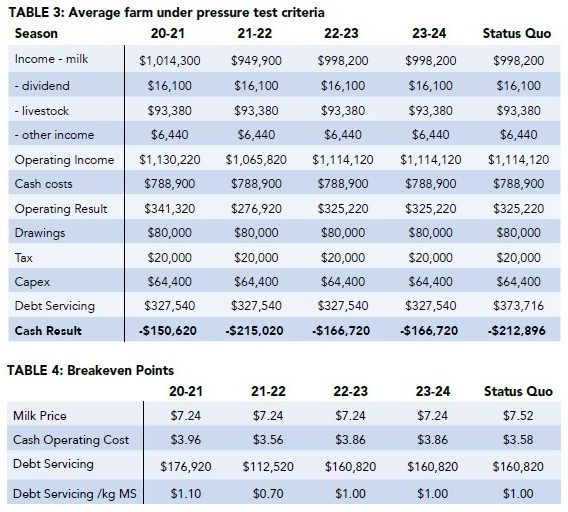

Using the assumptions derived from the average North Island Dairybase farm (18-19), then applying a banking pressure test, we can see that the average farm operating as it did in the 2018-2019 season could not meet the pressure test criteria. (Table 3).

A constant of negative cash results means principal is being repaid at the cost of building “seasonal” finance, which inevitably becomes term debt. This does not make sense.

Our next step in this analysis is to determine the point at which an average business could deliver a breakeven result – note this only applies by row – e.g: milk price breakeven assumes all other assumptions remain static.

The breakeven points table (Table 4) tells us that the average farm cannot expect milk price alone to rescue the position. Likewise, the average farmer is going to struggle to deliver a sustainable cash operating cost below $4/kg milksolids (MS). Neither is it realistic to think bank terms and conditions will alter in isolation to deliver a financially sustainable result.

It is acknowledged that this analysis has been done at a generic level and individual circumstances must be applied for a farm-by-farm understanding, but BakerAg has generated the following view.

- Under the pressure testing criteria that BakerAg are aware of, the average North Island dairy farm could not meet its I&P financial commitments.

- The structure and nature of farming in the South Island would suggest their position may be worse.

- Which means more than half of dairy farmers in NZ would be determined by the bank as outside criteria.

- What comes next for individual farmers… “we need to talk”?

The bank will work with farmers outside of criteria, but this requires good communication, in both directions.

- BakerAg acknowledges the industry is excessively leveraged, and now is the time of reckoning.

- Bank funding criteria as we interpret it, should be challenged. This is a national issue.

- And farmers must pursue an operating system that is more profitable.

- Interest rates are at an all-time low, and at $7+/kg MS good profits should be made. This is a good time to reduce debt.

What changes would BakerAg like to see?

From the above we can only advocate that both farmer and banker have a job to do

- As a national issue leadership and direction must come from the top. Government, industry, banking, advisers and Federated Farmers must seek and promote a solution.

- The table mortgage calculation is based on reducing all debt to $0 over 20 years. Could this be a reduction in debt to the point of say 80% equity. Absolute debt repayment being too big a hurdle.

- What flexibility is there in the banking criteria to accept interest only below an agreed milk price?

- All the trading banks say they are prepared to acknowledge and work with those farmers that have a history of debt reduction. What does this look like?

- Why 20 years? Could some farming families be looked at through a 25 or 30-year window?

- If a farm has well-maintained infrastructure, surplus feed inventory and/or high soil fertility this must create an opportunity for one to two seasons of deferred expenditure without impacting on productivity.

- Farmers must reduce the cost of production. $4.90/kg MS cash costs with debt of $26+/kg MS is clearly not sustainable.

- BakerAg would like to see proactive farmers running this pressure test for themselves and identifying their level of exposure.

There will be a follow-up article in next month’s issue of Milklines on this subject. We need to get more detail on why the average North Island farm has liabilities of $26/kg MS, is there more information to come from the banks in view of this situation?

- Feedback: to anne.lee@nzfarmlife.co.nz

(Article first printed in BakerAg Milklines newsletter)