Interest rates around the world are rising to combat imperialist war-mongering and pandemic-induced inflation, but the specific effects on markets vary. By Stu Davison.

John Maynard Keynes presented The General Theory of Employment, Interest and Money in 1936, profoundly changing economic theory at the time. It still drives the basis of most economic theory today.

One of the key theories outlined in this revolutionary work was “The Propensity to Consume”, which states that as interest rates increase, all else being equal, then the propensity to consume must reduce. See where I’m going?

So, we find ourselves in the middle of another period economics students will study for years to come: a pandemic, the fallout from the resultant monetary response by governments and then the bubbling global economy that is the result, let alone what Tsar Vladimir’s imperial war has done to oil, fertiliser and grain markets. Not to mention the pain as interest rates are pumped higher to cool raging inflation, before it burns through the value of any currency in front of our eyes and reduces us to mediaeval squalor. A stretch maybe, but a rough comparative for the basis for monetary policy responses to inflation. I’m sure you’ve made the link.

Interest rates are going up, so consumption will fall. Now, the tricky part is zooming into one commodity within an entire global economy.

Economic forecasts are relatively simple when you’re looking at the entire system. When looking at a diverse product like dairy, and how the consumption of the 100+ products that are derived from milk will shift, it gets difficult. Thus why most analysts stick to the big-ticket items, and use them as a proxy for the rest of the market; I’m not going to be any different, I’m just outlining why I can’t tell you the rate of change of cream cheese lollipop sales in China for Q2 2024.

So, the global consumer is faced with rising interest rates, along with the expectation that most developed economies will be in a recession at some point during 2023. As explained, we know the increases in interest rates will cannibalise overall consumption in some way, but the question is: where on the chain of value do consumers place dairy products today?

The 2008 Global Financial Crisis (GFC) resulted in dairy being consumed less by most consumers as dairy was viewed as a luxury, especially in Asian markets where it is not a cornerstone of the historical diet. This definition of luxury meant dairy was one of the first products left out of the shopping trolley.

But something is very different with this economic speed bump, post-pandemic is a very different position to post-GFC. Throughout history, pandemics change how humans behave around health and self-care, while financial crises just ruin the population’s trust in capital markets.

The easiest example here is the change in communication around the health or immunity benefits of consuming more protein, especially dairy protein, from the Chinese government during early stages of the pandemic. This change in association of products from “luxury” to “health product” is one of the key indicators that consumption levels of dairy are likely to be very different to those post-GFC. But it’s harder to pinpoint the scale of the change. This is partly due to the unknown impact of interest rate increases or the depth and length of the likely recessions.

The easiest example here is the change in communication around the health or immunity benefits of consuming more protein, especially dairy protein, from the Chinese government during early stages of the pandemic. This change in association of products from “luxury” to “health product” is one of the key indicators that consumption levels of dairy are likely to be very different to those post-GFC. But it’s harder to pinpoint the scale of the change. This is partly due to the unknown impact of interest rate increases or the depth and length of the likely recessions.

Notably, the significant change to Chinese consumption is the normality with which younger generations consume dairy. This wave of generational change is helping to cushion consumption, with the benefits of including a great source of calcium and protein into children’s diets not lost on parents in China.

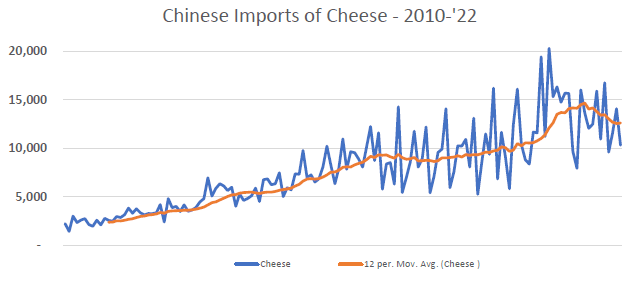

As a generalisation, we expect overall product lines like cheese, caseins and liquid milk consumption to have a much higher consumption baseline than 14 years ago, which is less likely to be influenced by inflation than other dairy products.

The entire cheese category is growing at a compound annual growth rate (CAGR) of 22.6% since 2008 in China, with yoghurt and sour milk products coming in second best, only managing a CAGR of 12.0% over the same period. So, we know interest and inflation are going to impact consumption over the coming year, without doubt. We are seeing these metrics change in markets already. However, we estimate that due to changes in consumer habits over the last 14 years, we expect baseline demand to be significantly higher than during the 2008 GFC, a small cushion for what could be a hard landing.