By STUART DAVISON

At this point of the dairy season, milk price volatility is rife, uncertainty around market movements is top of the agenda and Global Dairy Trade (GDT) events are looked forward to with much eagerness. This season is no different. By the end of July, this season consisted of four GDT events with negative price index movements, creating doubt around the top end of Fonterra’s opening milk price forecast.

Interestingly, over the last year, as a result of Covid-19, exports of liquid milk and cream out of New Zealand have increased significantly. I’m sure you’ve read about it, but the Chinese government advised Chinese citizens to drink more milk to boost their immune system.

This saw a mass change to the consumption levels of dairy in China, and resulted in a massive increase in the demand for liquid milk. Over the last year, processors in China have directed the bulk of their milk into liquid milk, significantly reducing the volume of milk powders produced.

As a response to this demand, NZ processors also ramped up all the ultra heat treatment (UHT) milk production they had, and pushed it into China as quickly as possible. At the same time, the imbalance this increase in local demand created away from the norm for China’s processors, created a larger demand for imported milk powders, both whole and skim. So, a double win for NZ dairy. But in the fast-moving world of dairy, how does that look going forward?

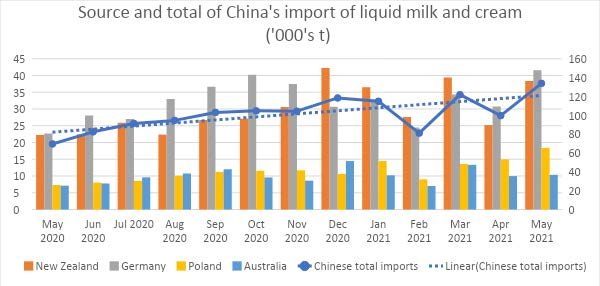

Well, if the current trend of imports of liquid milk is any thing to go by, then Chinese consumers aren’t slowing down. China’s May 2021 imports of liquid milk and cream were 92% higher than May 2020. In addition, NZ exporters have supplied 29% of that milk and cream, while the biggest supplier, Germany, has supplied 32%. Also, it is important to note that in April, milk production in China is at its spring peak. I think this category of Chinese dairy imports is key to understanding how quickly dairy consumption in China is changing, which has a direct impact on our own industry.

June 2021’s import data out of China shows the same trend; whole milk powder (WMP) and skim milk powder (SMP) imports lifted 87% and 47% respectively, highlighting the demand for milk powders that still exist as consumption changes. This is another stake in the ground showing that the overall trend looks like consumption is increasing, outpacing local production, and leading to a higher requirement for imports to meet demand. Which bodes really well for this season.

However, it is always good to look at the market as a whole, and understand risks that could bring this all crashing down rather quickly. One worry market commentators have at the moment is stockpiling in Chinese warehouses, as an explanation for the strong levels of imports over the last year. This is a very common concern, and this arises from the fact that we don’t have very good insight into what inventory levels are in China.

Global competition is another factor currently on the radar too, with the US and EU chomping at production growth as best they can.

Nations like Ireland and Italy have made some impressive milk production growth figures over the last 12 months, even in the face of adverse conditions.

The US dairy industry is the same, growing at an incredible rate, with over 18 months of very impressive growth figures. The problem with the US milk production growth is that their local consumption is not growing at the same rate, while also being hamstrung with Covid-19. This has resulted in more exports to keep their market in balance. SMP, dry whey and cheese have been their key exports, with the increase in cheaper US produced SMP globally seeing price sensitive buyers swap to this product. China has soaked up all the dry whey the US can produce.

As with any market, as prices increase, competition increases until prices correct. Supply and demand epitomised. So in short, for prices to remain high, demand needs to stay above milk supply. Simple.

- Stuart Davison, dairy analyst at NZX Agri.