By Amy Castleton

Dairy commodity prices saw a weak end to 2019, with prices at Global Dairy Trade (GDT) dropping 5.1% at the final auction of the year. We haven’t seen such a steep decrease since July 2018, when the index fell 5%.

The drop followed a 0.5% decline at the December 3 event, and overall prices ended up about where they were at the beginning of October. However, the January 7 event saw a bit of recovery, with prices up 2.8% overall. Prices have lifted a bit further at the January 21 event, particularly for WMP.

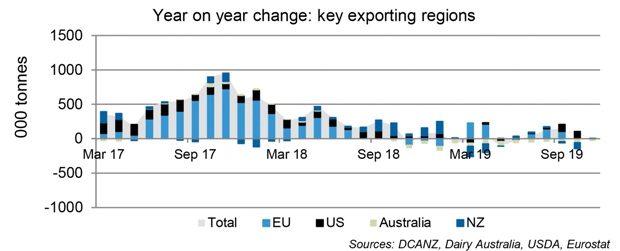

Global milk supplies remain weak. At a global level, 2019 milk supplies are likely to have been essentially flat against 2018 – December data is yet to be published for all regions. A little more growth is expected this year.

Commodity prices are reasonably strong, which is generally translating into strong milk prices, though some regions are better off than others.

New Zealand farmers look set to receive their strongest milk price since the 2013-14 season. High milk prices should be translating into higher production. However the relationship is not quite as straightforward as it once was; something we’re distinctly aware of in NZ.

Environmental policy, and particularly that on freshwater, is front of mind for many, and is holding farmers back from expanding or increasing their inputs too much in order to produce a higher volume of milk. For example, a high milk price would typically have NZ dairy farmers buying more supplementary feed; however the feed market has stayed fairly slow so far this season.

Costs of production are also creeping up elsewhere in the world. Small farmers in the United States have been exiting the industry as they can no longer afford to keep their farms running. US milk supplies are expected to grow just 0.3% for the 2019 calendar year, with just December data yet to be published. Growth is expected to pick up to +1.7% for the 2020 calendar year, according to USDA data.

Europe will be the region to watch, particularly in the first half of this year as the region goes through its peak. Milk supply growth is expected to pick up this year. The European Commission is forecasting +0.7% growth, compared to a +0.5% increase for 2019. It anticipates yields will improve, and that cow culling will slow.

Growth in global milk supplies is likely to see commodity prices start to come down this year, though we expect this will be more evident in the second half of the year.

The NZX Dairy Derivatives market largely has commodity prices starting to ease from about May or June. A $7+ milk price looks almost certain for the 2019-20 season. With the bulk of the production and selling for the season behind us, something drastic would need to change for this not to occur. But, we would expect a lower milk price for the 2020-21 season – though plenty can change before next season starts.