Dairy commodities had a good month in June with prices rising at both Global Dairy Trade (GDT) events. The GDT price index ended the month at the highest level it’s been since early April. There has been some good demand from South East Asia in particular and from China to a lesser degree.

Chinese demand has been growing but it faltered below the previous year’s levels at the June 16 event.

There have been reports that China has built some stockpiles of milk powder, which may explain why Chinese buying volumes have fallen below year-ago levels.

Sentiment seems to be leaning more positive at present, no doubt buoyed by the lifts at GDT. This can be seen by lifting prices for dairy commodity futures on the NZX Dairy Derivatives market, which are mostly up on month-earlier levels. The increase in prices – both on GDT and futures prices on the derivatives market – has resulted in a jump in the NZX milk price forecast for 2020-21, which in mid-June was $6.62/kg MS. This forecast does seem high and it’s likely to ease as the season progresses because pressure does remain on commodity prices.

While commodity prices have had a boost this month, the market is still volatile and it remains uncertain just how demand may play out over the next several months.

While commodity prices have had a boost this month, the market is still volatile and it remains uncertain just how demand may play out over the next several months.

Part of the demand story recently has been the easing of lockdown measures around the world and things starting to open back up to some degree.

This has meant businesses need to refill their supply pipelines, but this spike in demand for certain products won’t last forever and the question is what demand will look like once things settle again.

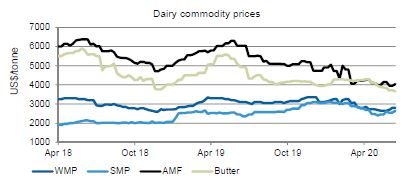

Oceania milk powders have done well this month. At the June 16 GDT whole milk powder (WMP) prices were up 2.2% and skim milk powder (SMP) prices were up 3.1%.

However, Chinese buying of WMP was well below year-ago levels. Oceania SMP prices provided the boost to overall SMP prices but European SMP prices did actually fall at GDT. There is plenty of SMP and non-fat dry milk coming out of the Northern Hemisphere, and these factors indicate possible headwinds that are yet to hit here in Oceania.

In the fat side of the market, butter prices slid 1% at the last GDT while anhydrous milkfat prices have been a bit more resilient.

Butter is more sensitive to the demand from food service, which is yet to fully pick back up.

Whilst lockdown restrictions are easing around the world many food service outlets can’t yet operate at full capacity and the demand at the consumer level is not necessarily there either.

So it’s unlikely that we will see much of a lift in demand for butter any time soon and thus prices are unlikely to see much movement either.

We’re still in a state where anything could happen but at this point things

look reasonably positive.