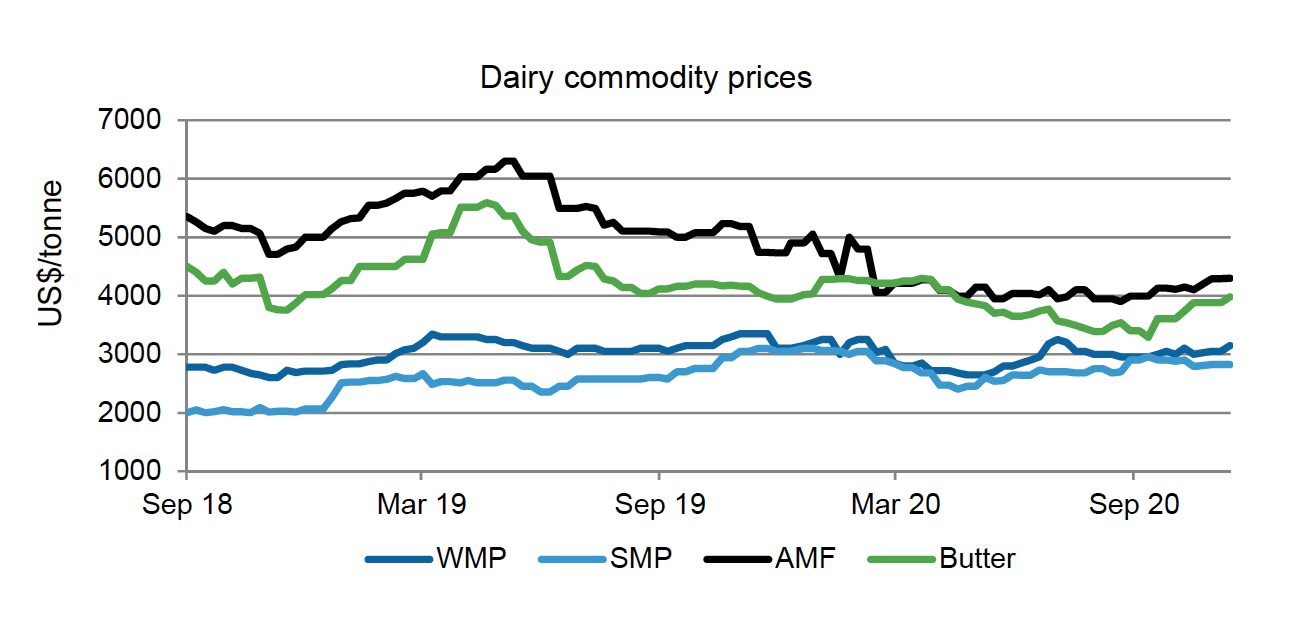

Dairy commodity prices saw a good bounce at the beginning of December, with the Global Dairy Trade price index increasing 4.3%.

In early December, milk powder prices were roughly where they were pre-pandemic, but milk fat prices were still lower than they were in January/February. Milk fat prices are also under the five-year average – butter is under the five-year average by about US$500/t and anhydrous milkfat by roughly US$850/t. However, this does include the period of time when milk fat prices were very high. Prices of around US$4000/t for butter and just over US$4100/t for AMF are not exactly low prices for the commodities, particularly considering the global food service sector is still not operating at full capacity and consumer demand remains uncertain.

Expectations at the time of writing are that commodity prices will stay roughly where they currently are for the next several months. Forward curves on the NZX Dairy Derivatives market are quite flat.

Whole milk powder (WMP) prices were sitting around US$3200/t in early December – just under where they were in December 2019, but well within the range of WMP prices pre-pandemic. Demand for WMP has been reasonably solid, particularly from China. Chinese buying was higher than usual late in the year. This appears to be buyers keeping supply chains stocked to ensure they have product on hand. Whether the demand will last into 2021 is the question, but at this stage there isn’t any indication of demand from China faltering.

Sentiment has been good recently. The news of Covid-19 vaccines becoming available has seen buyers become more confident.

The strength of commodity prices has given Fonterra some confidence in adjusting its milk price forecast. Fonterra has lifted the bottom end of its forecast range to $6.70/kg MS. With the upper end maintained at $7.30/kg MS, this puts the new midpoint at $7/kg MS.

At the time of writing the NZX forecast was sitting at $7.28/kg MS, right at the top end of Fonterra’s range. The NZX model is based on GDT prices for dairy commodities to date and the forward curve for dairy commodity futures on the NZX Dairy Derivatives market for the remainder of the season. The forecast therefore assumes relatively flat commodity prices at roughly current levels for the remainder of the season. Such a flat forward curve is fairly unlikely – the dairy market is typically not that steady! However, a farmgate milk price of around $7/kg MS certainly looks achievable this season.

Pasture conditions and New Zealand milk production also look to be turning around. Drought was looking pretty likely back in October/early November, with soils around much of the country much drier than usual. Pasture growth conditions dropped well below their average. By December everywhere had received some much-needed rainfall and pasture growth looks to be back on track for the time of year. There are some concerns with pasture quality that may affect milk supplies as we head through summer.

- Amy Castleton, senior dairy analyst at NZX Agri.