Words by: Amy Castleton

Dairy commodity prices continued to rise in February, though questions are starting on just how high they might go as some commodities reach highs not seen for several years.

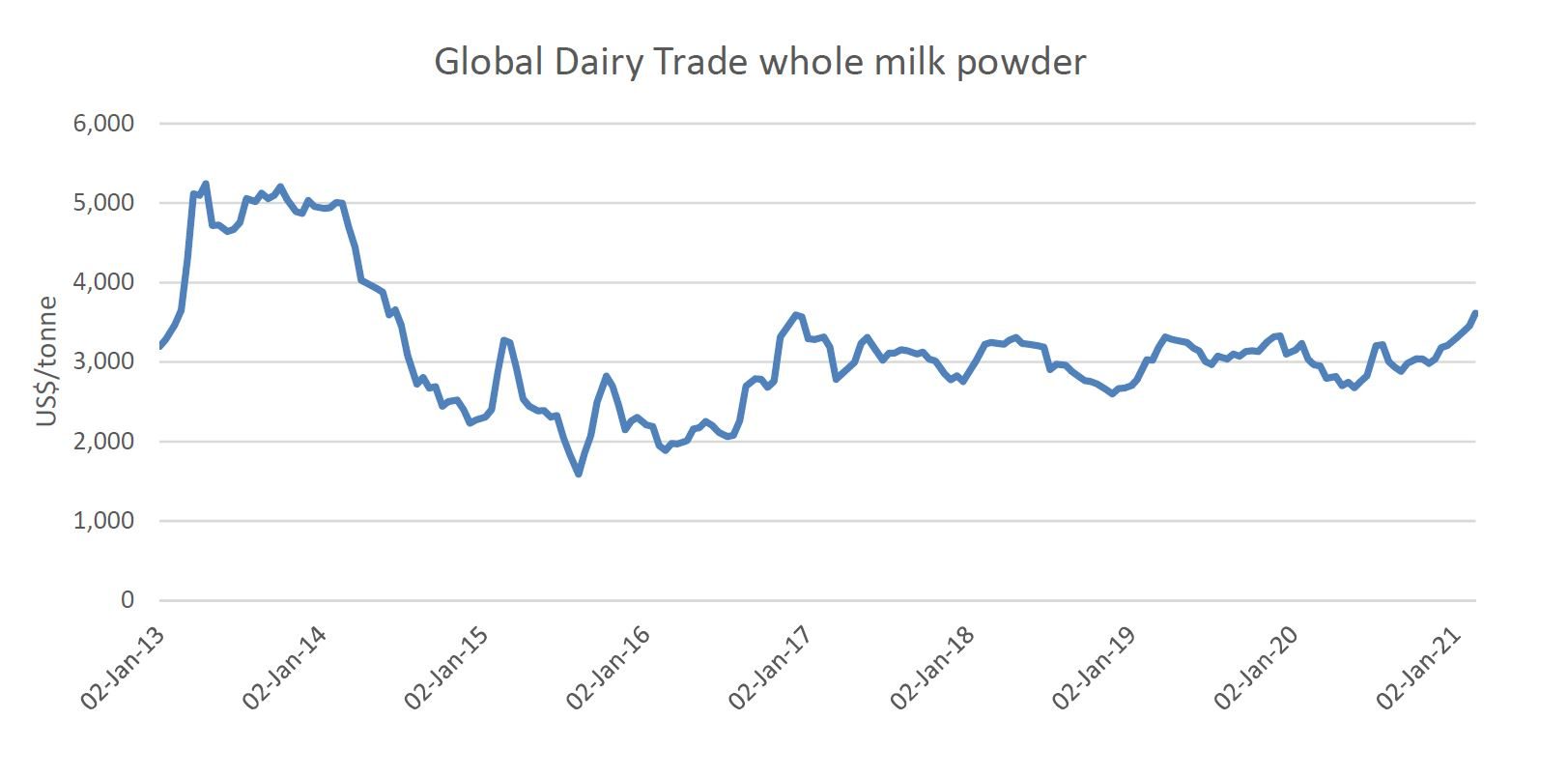

Prices rose 1.8% at the February 2 Global Dairy Trade (GDT) event, and another 3% at the February 16 event. The increase in prices has been spread across commodities, though whole milk powder (WMP) did lead the way at the February 16 event. WMP prices are currently sitting at their highest level since 2014.

Demand for product has been dominated by China, more so than usual. China has tended to buy a larger proportion of GDT product than it usually does – though Chinese buyers did step back a little during Lunar New Year. Demand has also been reasonable from South East Asia, but has continued to tend to be variable from other regions.

There have been reports that buyers are purchasing earlier than they usually do in order to contend with the logistical issues many are facing. There have been problems with shipping since the pandemic started, and the situation only seems to be worsening. At present, logistical delays are focused on the US West Coast, meaning many US dairy processors are struggling to get product out of the country. However, there are delays on other routes also, with shipping often taking longer to arrive than it usually does. These issues certainly aren’t unusual at present and buyers are tending to order earlier than they typically would to ensure that they have product on hand when they need it. This is helping to bolster demand for dairy – but what happens when warehouses are full and there is a lot of older product to be consumed? If demand continues in this way we could see a crash later in the year when there’s a sudden realisation just how much product consumers need to get through.

NZ milk supply has been relatively slow. After publishing a 2.7% decline in November, December production was up just 1% year-on-year, and January is also expected to be relatively flat (with data not yet published at the time of writing). This will also be providing support to commodity prices at present, though the market’s mind will soon start to turn towards Northern Hemisphere production as they head towards the peak of their season and the Southern Hemisphere starts to head towards its trough.

Early in the month Fonterra lifted its milk price forecast for the 2020-21 season. The revised range is $6.90 – $7.50, up from $6.70 – $7.30. Advance payments continue to be based on the midpoint of $7.20/kg MS. Fonterra said the main reason for the lift was strong demand from China and Southeast Asia for WMP and skim milk powder.

The NZX milk price forecast sits at $7.58/kg MS at the time of writing, slightly above the upper end of Fonterra’s range. Along with the rise in GDT prices, we’ve also seen increases in dairy commodity futures trading on the NZX Dairy Derivatives market. The outlook for commodity prices is strong for 2021 currently; however we do expect that prices will start to trend down by the second half of the year. This will mean downside risk for next season’s milk price.

- Amy Castleton, senior dairy analyst at NZX Agri.