Anne Lee

Rabobank’s recent report, ‘Afloat but drifting backwards’ details the macro-economic factors likely to see already stagnant dairy land values fall over the next five years.

Report author, dairy analyst Emma Higgins says the document aimed to inform so farmers and others in the sector can take action on the controllables.

The time frame banks and the Government put on debt reduction and environmental rules will be a crucial factor in determining how sharp the correction in dairy land values is, Property Advisory director Paul Mills says.

Over the past three years regulatory changes have created almost the perfect storm that’s led to a steep decline in available capital, ongoing lifts in compliance costs and a resulting loss of confidence among farmers and potential investors. At the same time Fonterra’s failure to make a return on farmers’ capital and loss of share value has hit agri-business confidence and farmers’ balance sheets.

Mills agrees with Higgins that Canterbury dairy land values could be in for a 10-20% correction. Where exactly the numbers land in that range will depend on the speed with which ‘proposed new rules’ are enforced.

“If banks want to aggressively reduce their exposure to dairy over 12 to 24 months then hold on to your hats, the dairy land price re-set could be 20%.

“If central government wants to compress the timeframe farmers are given to achieve 25-35% N loss reductions, to within the next election cycle, then that too will have a big impact compared with giving farmers 5-8 years to make those changes.”

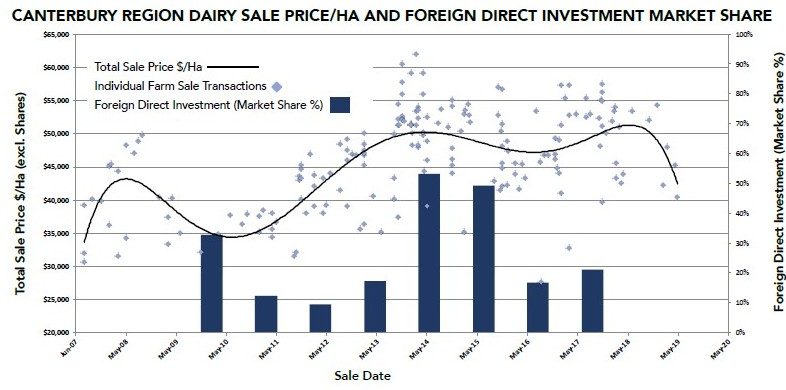

Mills’ analysis of Canterbury land sales over the past 10 years shows the effect of foreign capital in supporting land prices for a period.

“Even through 2016 and the winter of discontent with a $3.90/kg (milksolids) milk price, dairy land prices held up.”

Over the three seasons from June 2013 to June 2016 close to $500 million of foreign investment flowed into Canterbury dairy land sales with a portion of local farm vendors going on to invest in other properties, washing liquidity through the property market. Another $650m worth of sales were transacted over the same period by domestic buyers.

Since 2017, and the shift in Government policy, there have been no foreign farm purchases and in 2018 domestic purchases of Canterbury dairy land slumped to $77.6m. To date this year, there have been no dairy land sales in Canterbury but 42 farms are officially listed on the market, 21 of them in South Canterbury.

“We have a ‘nobody move’ kind of situation at the moment and there’s a wait-and-see approach from those who are in a position to buy – both in terms of knowing the extent of the land price re-set and having confidence to invest given uncertainty with the ability to achieve targeted N-loss reductions and the coming election.”

The strong payout is behind the market’s ability to stop trading.

“What we don’t want now is a fall in milk price south of $6.50/kg MS. That’s why we’re afloat.

“But we are going to drift backwards because if the market requires a 6% return on asset and the long-run milk price is $6.25-$6.30/kg MS and cost structures are at $4.25/kg MS then the maths says you’re not going to want to pay $50,000/ha.

“The positives are that as we come out of this deleveraging process farming businesses will be in a stronger position and there will be opportunities again for the next generation.

“There’s no doubt there is a substantial challenge ahead of the industry in the next two or three years but as we see return on assets go back up to 6-7%, farms will be investible again.”

- Listen to our podcast/interview with Rabobank dairy analyst Emma Higgins discussing the full report at

www.nzfarmlife.co.nz/dairy-exporter