A four percent drop in NZ milksolids production for the 2021/22 year and a tough year for overseas producers is supporting the great milkprice outlook for next season, Stu Davison reports.

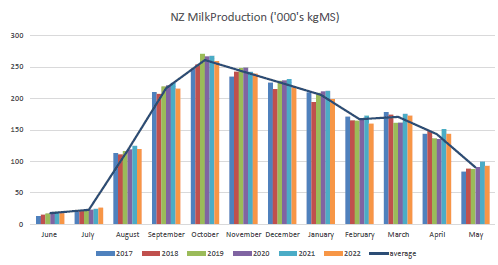

Milk production; for dairy farmers, it’s one of the most common conversation topics. It can start from a weather chat or it can finish a weather chat, and no matter the weather, milk production is the key driver of revenue on farm. So, now we have data for the full 2021-22 season, you can all compare your season with the national average. Also, it is worth noting how the rest of the world is tracking on milk production, as it helps to give guidance on expected milk prices going forward.

As I’m sure you’re painfully aware, the 2021-22 season was a tough one; not one part of the country got through unscathed. Southland had a drought, Canterbury and West Coast farmers had floods and Waikato farmers had a gnarly long dry spell, interceded with a cyclone… the list goes on, but it wasn’t easy – not that any season is perfect.

Now, all those weather impacts combined have created a full season production figure of 1,869,078,000 kgMS of milk sent to all processors. This figure is 4.03% lower than the 2020-21 season. That’s a phenomenal figure, 78,548,000 kgMS less than the season prior, and only just squeaking above the 2017-18 season’s total figure. Comparing the 2021-22 season to the season prior isn’t exactly fair. The 2020-21 season was a bumper, potentially the greatest volume of milk to ever be produced in NZ (that is meant to sound like a challenge, by the way!).

In terms of volume produced in the season, production fell 4.24%, or 947,000 tonnes. To visualize that volume, that is 37,880 fewer 20ft containers of dairy produced in the season (assuming 25t of dairy per container, it’s not really that exact). And for further clarity, the full 2021-22 season’s production would take 855,720 20ft-containers to move, very roughly. And with some google data, that would take 42 average container ships to shift the total 2021-22 season’s production, with roughly two ships less than the season prior. Of course this isn’t exact at all, just a guide for scale; what I’m getting at is that 4.03% less milk is a massive reduction!!

So, we had a tough season down here, but it must be noted that this has helped to support dairy prices over the last season also; some good with the bad. Now that we are dealing with winter, and counting the days until the herd starts calving again, what is the rest of the world looking like? Well, our biggest exporting competitor, the EU, is having a terrible time. Their milk production continues to decline; they have posted a year of negative milk production figures also.

Key growth countries such as Ireland, Poland and Italy have recently hit a wall, and all countries are posting negative growth figures. Why? Fuel, feed and fert, the three headline figures everyone is throwing around, are also impacting farmers in the EU. Added to these easy ones, environmental regulations are also punishing milk production expectations.

Currently in the Netherlands, regulators are looking to buy farmers out of some areas, to stop farming all together, which will have a forever outcome on milk production in those areas. So, it is unlikely that the global supply of milk will be increased from EU farmers while we are in our milk production lull of the year. Likewise, US dairy farmers are struggling with high input costs, and uncertainty also. The environment isn’t really a big issue in the US, yet. The US is increasing exports of dairy, but are still really only playing in cheese, skim milk powder and whey. Milk production in the US continues to creep along, but not at the rates seen over the four years to 2021.

So, overall, milk production globally is very constrained. NZ, the EU and the US are not turning on the taps as expected to the current high prices; there is too much downward pressure for farmers. However, this fact is also a key supporter of milk price expectations for the coming season. So, how did your production compare, and will you be aiming to produce more or less than the farm record this season? More importantly, can you exceed the farm record inside the current regulations?