Anne Lee

The possibility farmers could be called on to deposit significant sums into margin accounts if milk prices lift above the price they’ve sold their futures contract at is something farmers must work through with their banks and financial advisers before they use the new hedging tool,

advisers and brokers say.

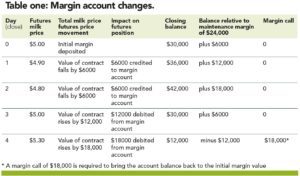

Understanding margin accounts and how they work is critical to ensure people go into the contracts with their eyes wide open to all possible outcomes, First NZ Capital head of derivatives Mike McIntyre said. When a futures contract is taken out (both bought or sold) a percentage of the value of the contract, typically 5-10%, is deposited into a margin account as a good faith bond.

The account is used to help settle out the trade when the contract is closed out at the agreed future date of the contract. During the course of the contract a margin call may happen, requiring participants in the contract to deposit more money into the account if the balance of the account falls below a trigger point known as the maintenance margin.

If a call occurs the participant deposits an amount which will bring the margin account back to the initial margin value. McIntyre said farmers must ensure they have the right credit facilities in order with their banks so they can accommodate a margin call if it happens and that their bank is also fully aware of their hedging plan.

Farmers had been hearing examples involving big hedges in terms of the number of kilograms of milk solids hedged and big price movements which inevitably resulted in very hefty five figure margin calls.

Farmers needed to look at their own situation, go through the exercise of what could happen under different scenarios and take sound advice, he said.

Some are wary of complicated financial instruments following issues with interest rate swaps, marketed to farmers by some banks between 2005 and 2009, which resulted in some farmers making significant financial losses.

In 2015 more than 250 farmers were compensated using out of court settlements between the Commerce Commission and three major trading banks with settlements totalling $24.2 million.

OMF director of financial markets Nigel Brunel said there are cash flow implications with margin accounts and farmers need to be aware of that but once the futures contract is settled the margin account is used to close out the trade and gains or losses in that account balance out against what’s gone on in the physical market. In that respect margin calls and the money sitting in the margin account aren’t an extra cost or additional loss – it’s just part of the overall trade.

Farmers need to talk to their brokers and financial advisers to ensure they’re fully aware of all the implications.

How margins work

When a futures contract is taken out an initial margin must be deposited with NZX which is typically between 5% and 10% of the full value of the contract.

When a futures contract is taken out an initial margin must be deposited with NZX which is typically between 5% and 10% of the full value of the contract.

The money is deposited into the farmer’s margin account and the value acts as a good faith bond. At the end of the contract period, at the time of settlement, the deposit is refunded plus or minus any gains or losses on the futures contract. But during the course of the contract a daily settlement price for the futures contract is set too, revaluing the futures price at the end of each day.

The daily settlement price is based on the prices that product is traded at, or offered or bid at on that day, or in the absence of these prices, other relevant indicator prices. The balance in the margin account in terms of where it sits relative to the daily changes in the value of the contract will fluctuate.

If the futures price moves against the contract to the extent the amount in the margin account is below the maintenance margin, a margin call can be made and the farmer will be legally required to deposit more money into the margin account.

In a farmer’s case, where he or she hedges their milk price by selling a futures contract, a movement against the contract happens if the milk price rises.

In that case the farmer is said to be “out of the money” in the futures market but in the physical market the price being paid for his or her milk will be increasing and they’ll be “in the money” to the same extent.

Example:

- A farmer sells 10 milk price contracts for $5/kg MS.

- Ten milk price contracts cover 60,000kg MS.

- Total value is $300,000.

- Initial margin is 10% of $300,000 = $30,000.

- Maintenance margin is $24,000.

The margin account balance increases and decreases over several days as the daily settlement price fluctuates.*

The margin account balance eventually falls below $30,000 to $12,000 in the example when the milk price futures price goes to $5.30/kg MS. At that point a margin call will be made and the farmer is legally required to deposit another $18,000 within 24 hours into the margin account to bring the margin account balance back to the initial margin value.

The more contracts the farmer has sold or the greater the milk price shift, the larger the margin call will be.

* Fluctuations are hypothetical to enable explanation.

Definitions

Margin acts as a good faith bond and is an amount of money which must be deposited into a margin account that’s held and guaranteed by the NZX when the futures contract is taken out.

Initial margin is the amount of money that must be deposited. It’s calculated based on the volatility of the product. NZX uses the Standard Portfolio Analysis of Risk (SPAN) margin system to calculate the initial margin value.

In the case of NZX Milk Price Futures the initial margin is likely to be between 5% and 10% of the value of the contract. Maintenance margin is the lowest balance amount an account can drop to before it must be replenished to the initial margin amount.

Variation margin is the daily profit or loss calculated based on the latest daily settlement price.

A margin call is made when the margin account balance falls to or below the maintenance margin. Daily settlement is the price the market closes out at each day. A margin account is marked to market each day in that the margin account balance is recalculated each day based on the daily settlement price.

Dairy options

Options contracts act like an insurance policy, giving the person buying the contract the right, but not the obligation, to buy or sell something. In the case of NZX dairy options, a farmer would buy an option to sell a milk price futures contract.

The right to sell is referred to as a “put” option. The farmer would buy the put option to protect against the possibility of the milk price falling below a strike price agreed to in the contract, but would retain the right to benefit from any increase in the milk price.

The option contract has an expiry date and if a farmer doesn’t want to sell the option at the strike price because the milk price has gone up he or she will let the contract expire and waive their right to sell on the futures market.

The price paid for the put option is similar to a premium in an insurance policy in that it is a true cost and not returned to the farmer. It must be deducted from the price the farmer receives on the physical market, if they let the contract expire, or the gain made in the futures market if they exercise the put option.

Check out Dairy Exporter June 2016 for more coverage on Options, and for a numerical example check out http://farmersweekly.co.nz/milk-price-derivatives