Amy Castleton

Fonterra has lifted the mid-point of its milk price forecast for the 2019-20 season to $7.30/kg milksolids (MS), and narrowed its forecast range to $7-$7.60/kg MS. The NZX milk price forecast is close to the top end of Fonterra’s range at $7.48/kg MS.

Dairy commodity prices look set to remain relatively steady at least through the remainder of NZ’s dairy season. There is more downside than upside risk. A lack of growth in global milk supplies is what is keeping commodity prices where they are, and it’s more likely that growth in global milk supplies will accelerate rather than decline.

The Northern Hemisphere is at its low point for the year, in terms of milk supplies. Neither the European Union nor the United States are expected to see much growth for 2019 as a whole. For the EU this has mostly been a weather story – and growth is expected to improve as we head through the end of 2019 and into 2020.

The US is a little different, as it has mostly been high costs of production impacting margins and pushing smaller farmers out of the industry – though there has been some weather effect too. A lack of feed supplies is expected to keep milk production growth down over the winter. Growth in US milk is also likely to improve through 2020.

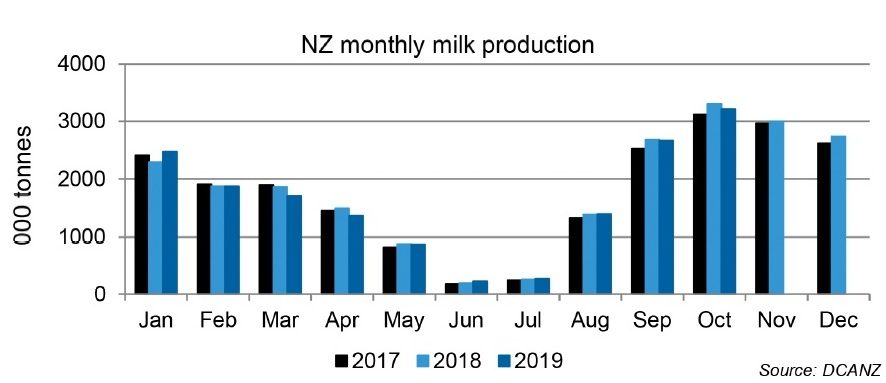

New Zealand milk production shrank 1.5% year on year in October, on a milksolids basis. Tonnage was down 2.7% year on year. NZX had been forecasting flat production against last October, however October 2018 was a record and was always going to be difficult to match, let alone beat.

While weather and pasture growth conditions have been fairly good, they have not quite matched those of last year, and thus milk production didn’t quite live up to last year’s high. October 2019 production was up 4.8% against October 2017, and up 2.1% on the five-year average (on a milksolids basis), so was still actually quite a good volume.

Season to date, production is up 0.5% on a milksolids basis, though it is down 0.7% on a tonnage basis.

The NZX forecast has eased marginally, and now sits at +0.6% for the full 2019-20 season. We are expecting little change in milk supplies until January, slightly higher increases in February and March, and some declines in the final two months of the season. Our forecast still assumes basically ‘normal’ weather conditions.

The flooding in the South Island in early December is likely to have some impact, though it will be much more significant for the individual farms affected than for overall NZ milk production for December.

Fonterra has lifted its milk production forecast for the season, and now expects to collect 0.5% more milk than last season. It was forecasting a 0.2% decline.

It’s likely that milk production and commodity prices will continue to track along current trends as we head into the new decade. A $7+ milk price should be achievable. But as we look to the 2020-21 season, milk production growth is likely to improve, and naturally commodity prices will start to come down, so we anticipate a lower milk price next season.

- Amy Castleton is an NZX dairy analyst.