Negotiating a contract

There can be a power imbalance when a farm owner and potential contract milker or sharemilker sit down at a table to negotiate their contract, still both parties will benefit more from a fair negotiation. Words Sheryl Haitana.

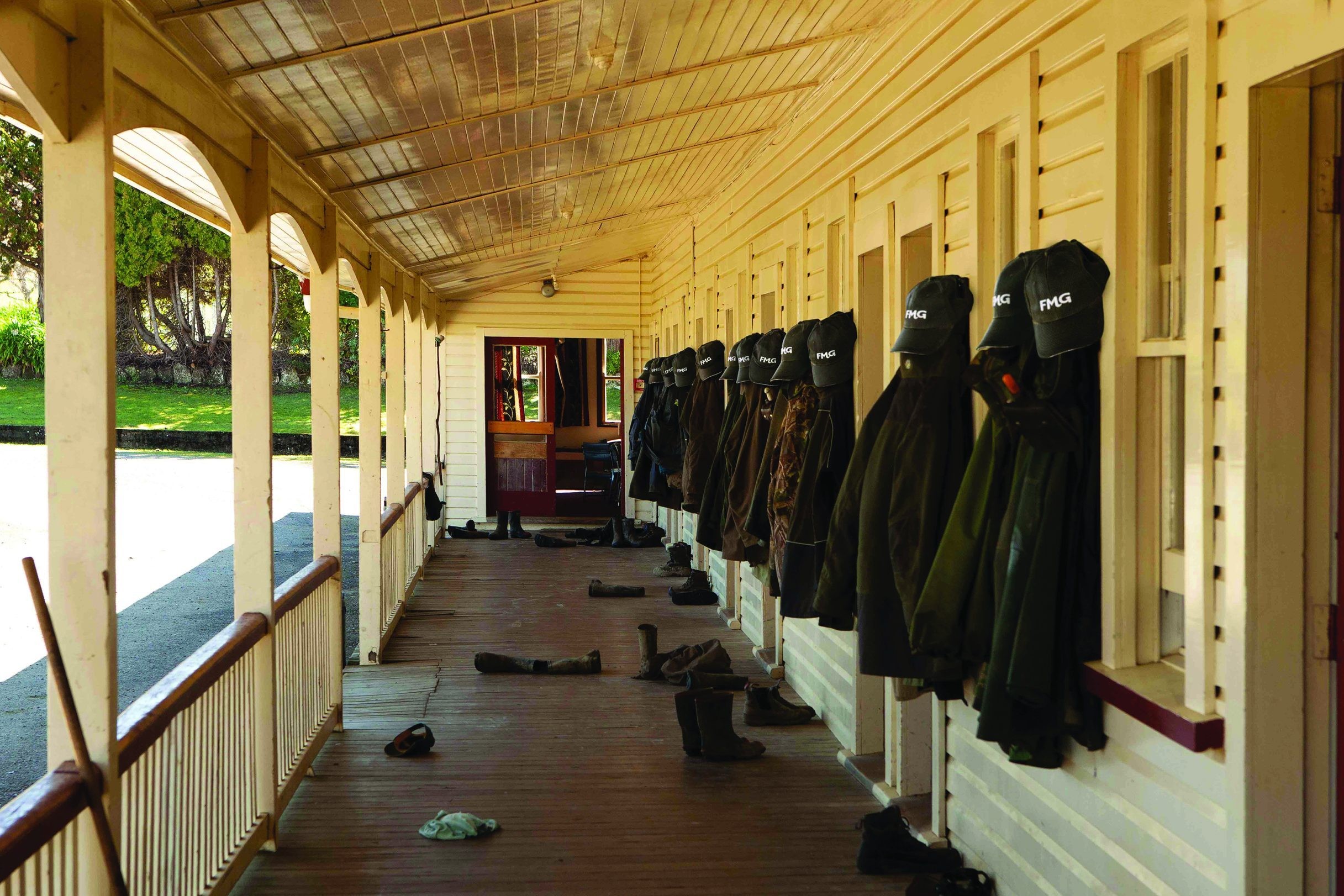

IN PARTNERSHIP WITH FMG

A contract milker or sharemilker is usually eager to lock in the job so they may be willing to sign a contract quickly, or they may be more inexperienced and not fully understand the responsibilities or costs that they are signing up for, says FMG North Island Manager Jason Rolfe.

“At this time of year, people are signing a new contract or adjusting an existing contract. There often is a power imbalance, with the farm owner being the one with the asset. People need to know what they’re signing up for and should get some independent advice. People are signing up for contracts without understanding their risks and may be unable to honour the agreement if things go wrong.” Managing your risk with insurance is part of a risk management strategy, but it starts with a good agreement and understanding from both parties, he says.

“I’ve seen some contract milkers who are earning less than a farm manager, without any time off and they get burnt out. There are also sharemilkers in DairyBase who are not breaking even, which is concerning.”

All scenarios should be discussed and both parties should be aware of their costs, including contingency plans if production is significantly lower than budgeted.

“Costs are often fixed regardless of production, so if you’ve budgeted for a set production, and for seasonal reasons or other circumstances that production can not be hit, people need to understand their responsibilities, costs, and the range of potential income,” explains Jason.

Farm owners and the contract milker or sharemilker should also discuss key person cover for what happens if a person is injured or has an illness.

“In some situations the farm owner might be in a position to jump back on farm to do the day-to-day work, but if it’s an absentee owner, relief staff will need to be employed. If a contract milker for example hasn’t got personal cover and they end up having to pay wages, that will cut into their profit.”

Both parties should also have conversations about liability insurance regarding claims and who is responsible for what. For example, if there is damage to the farm dairy and the contract milker cannot milk the cows for the rest of the season, does the farm owner have insurance to pay the contract milker out for a set amount of production? Who is responsible for the cost of contaminated milk and the tanker of milk that is contaminated? Does the contract milker have the insurance to reimburse the farm owner?

“For a contract milker, if there is a vat of contaminated milk, they not only lose their profit but also have to reimburse the farm owner,” says Jason. “They don’t necessarily have the cashflow or asset base to absorb these losses if they don’t have insurance cover.”

These conversations can be tricky and it’s a good idea to get some independent advice.

There are plenty of advisors out there, accountants or lawyers, who offer a 90-minute free consultation for people who are looking to sign their first contract too. Both parties benefit from a fair and profitable contract, Jason says.

“If you look after your people, you’re more likely to retain them. It is a big cost to upskill new staff every year or every three years; there is lost production and profitability.

“If you look after your people, they will look after you.”

Visit fmg.co.nz