New Zealand Dairy Industry’s Continued Resilience

El Niño didn’t hit like expected which has seen NZ milk production stay steady with strong demand for our product.

Words Rosalind Crickett

As the milk production season draws to a close, the New Zealand dairy industry has proved its resilience yet again, despite facing a number of challenges. This resilience has been showcased across several avenues, beginning first with domestic milk production. The early warnings of the incoming El Niño Southern Oscillation had dairy farmers and industry participants on edge, with many initially concerned about the production implications that would typically follow suit.

Overall, to date, NZ milk production has remained steady, seeing consecutive year-on-year production growth from September to December on a milk solids basis, until January, where it saw a marginal decrease of 0.6%. The lack of presence of El Niño in New Zealand had NIWA branding this weather pattern as an ‘atypical’ one, with regions feeling little impact of the weather event until later this summer. The late onset plus increased rainfall across November and December helped buoy production as the country saw optimal pasture growth conditions – with word on the ground from farmers that little supplementary feed was needed.

The geopolitical tensions and climate patterns around the globe have also placed another series of hurdles in the face of international dairy trade. The war in the Middle East and subsequent threats from Houthi rebels in the Red Sea meant delays through the Suez Canal – adding 9-14 days to shipping lead times for products travelling around Africa’s Cape of Good Hope. This has been compounded by the drought conditions caused by El Niño in the Panama Canal, leading to questions about the canal’s viability and ability to withstand climate change.

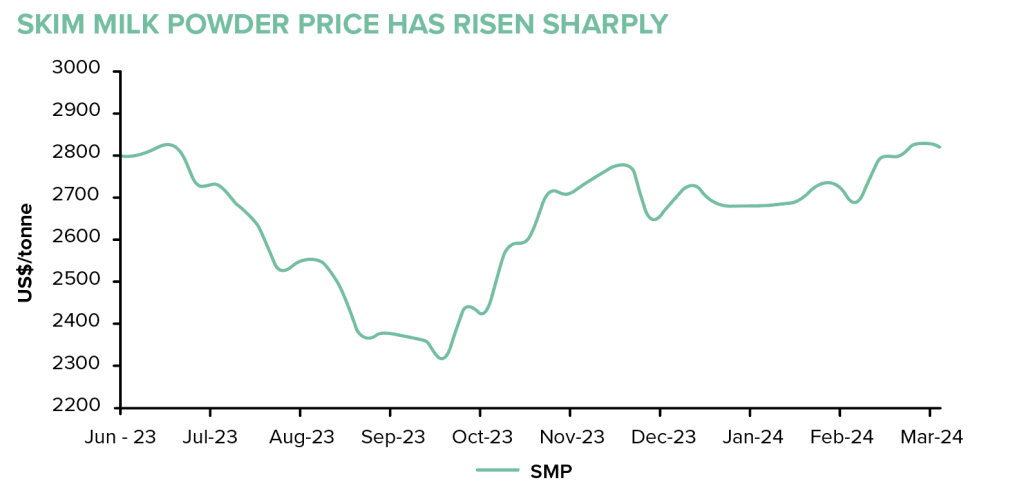

However, as NZ does not typically utilise either the Panama or Suez canals for shipping routes, NZ product saw increased demand from buyers on the Global Dairy Trade (GDT) platform – with January NZ dairy exports up overall 12.5% YoY. For instance, skim milk powder (SMP), which typically European product carries a premium, saw the changing of tides – with NZ SMP boasting a US$213/t lead over the equivalent European product at GDT #349. The shipping delays also led to increased demand across all products in the immediate to near term, with those contracts seeing the largest price increases.

Since the beginning of the season, we have also witnessed dairy commodity price recovery – albeit with a few fluctuations along the way. At the first GDT Trading Event of February, commodity prices surged across the board, with many reaching the highest prices seen since 2022. The consecutive increases in the GDT price index from November through February, has seen Fonterra increase its farmgate milk price 30 cents to now sit at a mid-point of $7.80kgMS.

Overall, NZ’s ability to adapt and adapt quickly to ever changing dynamics in a very volatile market provides us with a competitive edge. This, combined with the fact that NZ competes against a heavily subsidised global dairy industry is a testament to NZ’s resilience. Moving forward, continued vigilance and proactive measures will be essential to mitigate risks and capitalise on growth opportunities in the ever-evolving dairy landscape.