By Amy Castleton

Dairy markets are largely steady as she goes at the moment. May has continued to be quiet for dairy commodity prices. There have now been four consecutive auctions with very little change in the Global Dairy Trade (GDT) price index.

Dairy markets are largely steady as she goes at the moment. May has continued to be quiet for dairy commodity prices. There have now been four consecutive auctions with very little change in the Global Dairy Trade (GDT) price index.

Prices were down 0.7% at the May 4 auction and eased another 0.2% at the May 18 auction.

Whole milk powder (WMP) prices remain well over US$4000/t. This is a price point where we would usually start to see some downside pressure, especially with some of the milk production data we have seen out of New Zealand over the past couple of months.

However demand remains strong, particularly from China, and there doesn’t appear to be much pressure on prices any time soon.

China has continued to buy more product than last year across most commodities on offer on the GDT platform.

This has particularly been the case for WMP and butter, both products for which Fonterra has added volumes to the GDT platform in recent months.

At the May 18 GDT event, WMP offer volumes were up 28% compared to the May 19, 2020 event and butter volumes were 59% higher.

The extra volume has had some impact on butter prices, but very little impact on WMP prices.

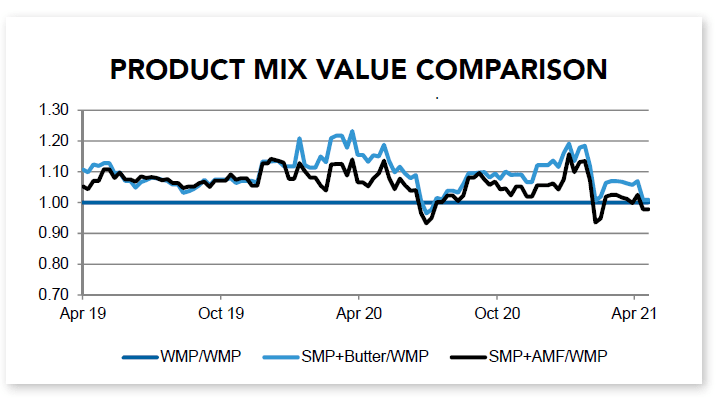

Following the May 18 GDT event, it remains marginally more profitable for NZ processors to produce butter than to produce anhydrous milkfat (AMF).

However the price ratios of a mix of SMP and butter, SMP and AMF or WMP are virtually the same, meaning demand for certain products is likely to be driving processing decisions at present.

New Zealand milk production was up a huge 8.7% year on year in March. At the same time last year we were in a drought, but even so the leap is big.

Market expectations are that we will see another big lift for April milk production (data is yet to be published at the time of writing), with pasture growth conditions having continued to be very good for this time of year.

We expect there are also still more cows around than usual as it has been difficult to get cows into the works.

Furthermore the excellent milk price forecast and likelihood of another high milk price next season will have some farmers milking a bit longer than usual. The NZX forecast for the full 2020-21 season was +0.9% in mid-May, though it’s likely there is some upside in that forecast.

At the time of writing, Fonterra is yet to release its opening farmgate milk price forecast for the 2021-22 season. However the NZX forecast is currently sitting at $8.36/kg MS, and it’s quite likely that the midpoint of Fonterra’s range will start with a $7.

The NZX forecast has priced in some downside in dairy commodity prices, as indicated by the NZX Dairy Derivatives market. But, given we are only at the start of the 2021-22 season, there is plenty of room for movement yet.

We are certainly not far enough through to confidently say that there will be an $8 milk price this season.

- Amy Castleton, senior dairy analyst at NZX Agri.