Despite world milk supplies stuttering, inflation pressures all around and market confusion, prices are holding firm, Stuart Davison writes.

Supply and demand remains a key fixture of tracking any market, a classical approach to understanding how and why a market has shifted, why prices are where they are and how the market is likely to operate.

This year has been a very interesting case of this for the dairy market, however – not as simple as the inversion of the two market forces.

In early 2022, dairy demand during the first quarter was strong, with China managing to import its largest volume of dairy products during the tariff-free window in January. Most was whole milk powder (WMP), with a good chunk of skim milk powder (SMP) involved too. At the same time, prices were tracking significantly higher, pushing WMP prices through US$4000/tonne for most of Q1.

Fast forward to the second quarter, and the global situation had flipped. China was backing out of the market in a hurry, and the rest of the world was unable, and unwilling, to take up the slack.

During Q2, milk supplies globally started to stutter too. European Union production figures continued their trend of declines, with input costs, weather and uncertainty affecting farmers’ ability to push milk production growth along. Likewise, United States farmers were starting to buckle in the face of market pressures. Subsequently, even with both demand and supply easing, prices eased as we traversed through the end of the first half of 2022, with WMP prices roughly 13% lighter at the end of June than the peak achieved in March.

The key note of Q2, and the first half of the third quarter was the “wait and see” approach the market adopted.

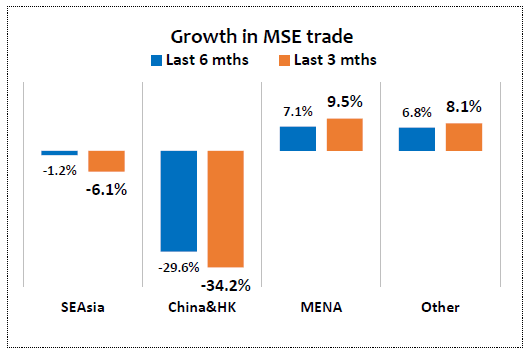

To put this into perspective, overall import figures from key import regions over the last six months are tracking roughly 60,000t behind the same period last year by the end of July, with China’s overall dairy imports falling about 150,000t. Regions like the Middle East, Africa and the EU tried to make the most of the situation, increasing imports compared to the same period last year. Even so, a net 60,000t reduction is a serious chunk of product missing out of the global trade books.

For New Zealand exports the variation was a little bigger. NZ WMP exports to China from January through August in 2021 made up 46% of our total WMP exports, whereas the same period in 2022, China was only 32% of our WMP exports, with total WMP exports declining 18% YoY. Demand in the market is now only registered as “slightly-firm”.

Looking at the end of Q3, the entire dairy market is still in this odd pattern of demand and supply both falling, keeping prices somewhat supported. September’s Global Dairy Trade events seem to show prices are turning higher; WMP prices increased, milk fats tracked a little higher, SMP managed to retain most of its premium, and cheese prices continue to be supported. But one month’s results aren’t a perfect indicator.

As we finish off 2022, the market is still in the holding pattern, but, we do know that milk supply globally is driving more market sentiment than normal. All three major dairy producers, NZ, EU and the US, are looking at printing negative figures. Expect to see big market shifts when DCANZ data shows how far behind NZ milk production is on the year before at each month moving towards Christmas.

So, global milk supply will likely continue to ease, helping to deliver some support to prices. Going the next level up, into the processed products, less WMP is expected out of all processors in NZ this season, with a greater proportion of milk processed into SMP and milk fats, and other consumer goods – think casein or UHT cream. The commodity market is incredibly different this season compared to the last two; SMP and milk fats will continue to be the hot products, with WMP taking a backseat.

On the demand side, there is net confusion in the dairy market. Inflation should be hitting consumers, but it doesn’t seem to be having the expected impact yet. Exchange rate fluctuations should be inhibiting dairy buyers , but that hasn’t happened yet either. There is likely more upside from the US$yet, which means more pain for dairy buyers, but it isn’t having an impact.

Dairy might be able to weather the expected global recession, provided consumption continues to grow on a trend similar to that seen over the last 15 years. Our minimum expectations are that demand should remain firm enough for the rest of the season to keep dairy prices in a good spot – there are still upside expectations. The entire global dairy market is watching China, and when the market sees China return, expect to see prices surge.