Tax no surpises

Forecasting your season ahead and picking the right tax payment system may help to avoid that unexpected eye-watering tax bill.

Words Trudi Ballantyne

Listen to the podcast:

One of the pet hates a rural bank manager has is the phone call from a farmer asking for an overdraft extension to pay an unexpected tax bill.

The volatility of farming incomes can often lead to tax surprises – where you are suddenly asked to pay a large amount of tax or where you receive a large tax refund because you shouldn’t have had to pay the tax in the first place.

The traditional provisional tax system means tax payments for the current season are based on what your farm earned in the previous season – or if your financial statements are prepared late – on what happened the season before that. As we know, milk prices, onfarm costs and changing interest rates cause farm profitability to drastically change from year to year – meaning the tax being paid may not be based on up-to-date information.

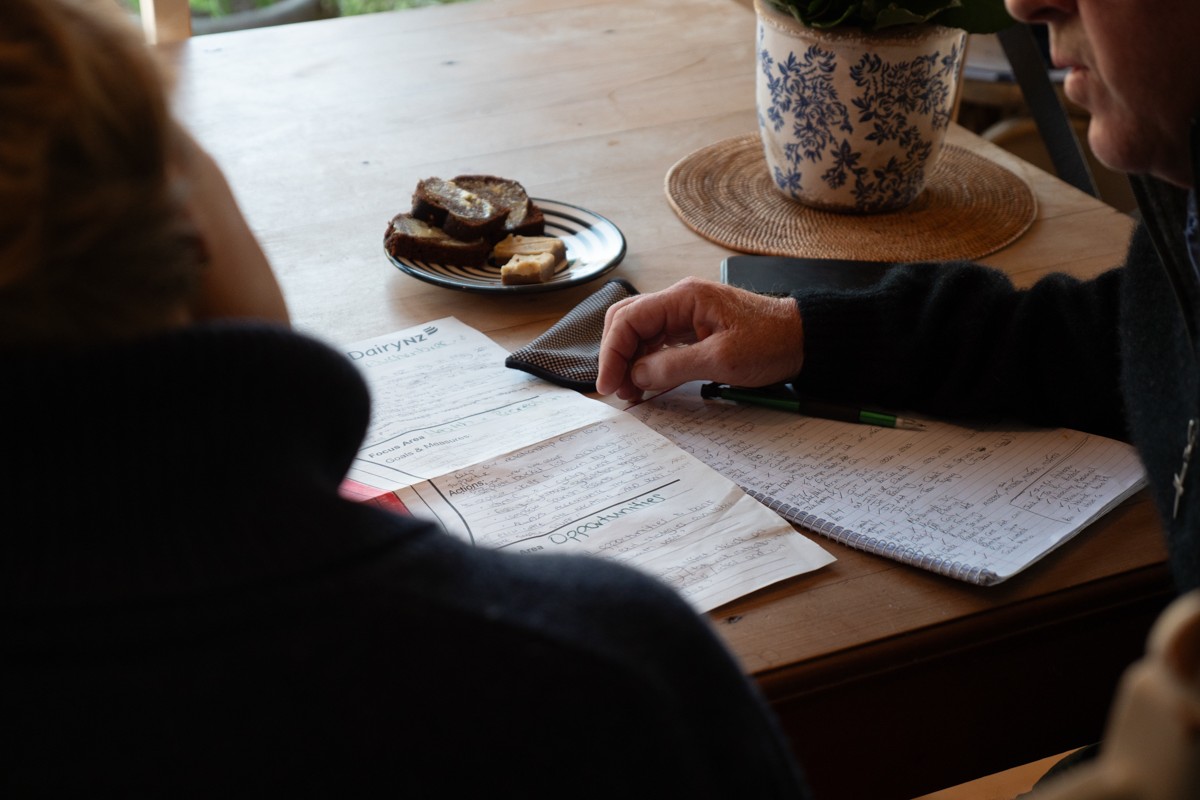

To avoid this, farmers need to “know their numbers”. They need to prepare a forecast to understand what the year ahead looks like. There are some excellent software providers out there that, in conjunction with your accountant, can make this a pain-free process. Once you have a draft budget, ask your accountant to look it over and add in the likely tax flowing from those numbers. By doing this, you are highlighting to your accountant that your profitability is going to vary from the previous year, and you can start a discussion about the best way to handle the tax volatility.

If your profit is going to increase, you may want to consider making a voluntary payment to IRD to avoid hefty interest charges. Alternatively, if your profit is dropping, consideration should be given to filing an estimate with IRD.

There is an alternative to the traditional provisional tax system – AIM – Accounting Income Method. This system allows you to pay your provisional tax every two months alongside your GST. The payment is calculated based on your actual profit for the two-month period. This means you are only paying tax in the periods you make a profit. This may mean that for the first half of the dairy season, provisional tax payments are minimal with higher payments later in the season as cash starts to flow.

AIM returns do need to be filed in conjunction with your accountant. They need to check over the coding in your accounting software and make sure things like asset purchases and depreciation are calculated correctly every two months – but this is stuff they have to do at the end of the year anyway. By getting an accurate profit result every two months, you get to the end of the financial year with some certainty that your provisional tax payments made via AIM are reasonably accurate and the money left in the bank at the end of the financial year is all yours.

Whether you use the traditional provisional tax system or the newer AIM system, being proactive with your financial forecasts means you can avoid nasty tax surprises.