Anne Lee

The hardest thing about taking on a price risk management strategy to manage milk price income is changing your mind-set, Canterbury dairy farmer Marv Pangborn says.

Marv, a former rural banker and farm management lecturer at Lincoln University, has been using a price risk management strategy for the past five years.

He initially used Fonterra’s Guaranteed Milk Price and when that was discontinued he ventured into using the NZX milk price futures market.

“This is where you have to really change your whole mind-set because you’re moving away from being a business that tries to maximise profit – even though you have no control over your milk income – to a business that wants to have a steady, safe profit,” he says.

Marv and his wife Jane own two dairy farms and have 250 hectares of support land north of the Rakaia River.

One, a 520-cow farm, is run by a contract milker and the other, a 680-cow property, is run by a 48% sharemilker.

Marv outlined their hedging strategy at workshops run recently by Lincoln University in collaboration with NZX and Fonterra that aimed to give farmers more understanding of both futures markets and Fonterra’s new Fixed Milk Price.

He said that in his case, managing milk price risk allowed a more stable level of profit which in turn made it easier to make longer term strategic decisions.

It also increased the business’ resilience and made it better able to cope with one-off chance events such as this season when they were hit with a $50,000 irrigation breakdown.

Everyone has a different risk profile though so everyone’s strategy – whether they want to participate in managing price risk and how much of their milk they want to cover – will be different.

In their case the aim was to pay down debt as part of their succession plan, Marv says.

“The first step in using something like this is to determine your breakeven milk price and then determine the free cash you want – the money you want available each year after tax.”

Breakeven price = operating costs + interest + tax + drawings

In their case that was $4.59.

The difference between your total income and your breakeven milk price will be your free cash.

“In our case we want $550,000 of free cash each year to fund capital expenditure, cover unexpected expenses and pay down debt. Knowing that financial goal helps us set up our milk price hedging policy. Everyone’s situations are going to be different so the numbers will be different but it’s important to have a policy so you can determine how much milk at a specific price you will hedge.”

Farmers will also need to talk to the bank to establish a trading account for margin calls, which Marv says is best kept separate from the farm’s main overdraft account.

In his case the account has a $350,000 limit. To see more about margin calls and how futures markets work, see Dairy Exporter May 2016 at www.farmlife.co.nz. Search ‘Smoothing out future prices’ and ‘Margin accounts: the lowdown’).

A margin call requires money to be deposited into the margin account if, in a farmer’s case the milk price rises beyond a certain level. The margin account is used to settle the futures transaction when the futures contract closes out.

Marv says they have used a simple strategy to help determine how much of their share of the milk they should hedge each season – the lower the milk price the less they hedge but the higher the milk price forecast the more they hedge.

If the milk price is expected to be $4.30, for instance, they may only hedge 20% of their milk and at over $6 they may hedge 60%.

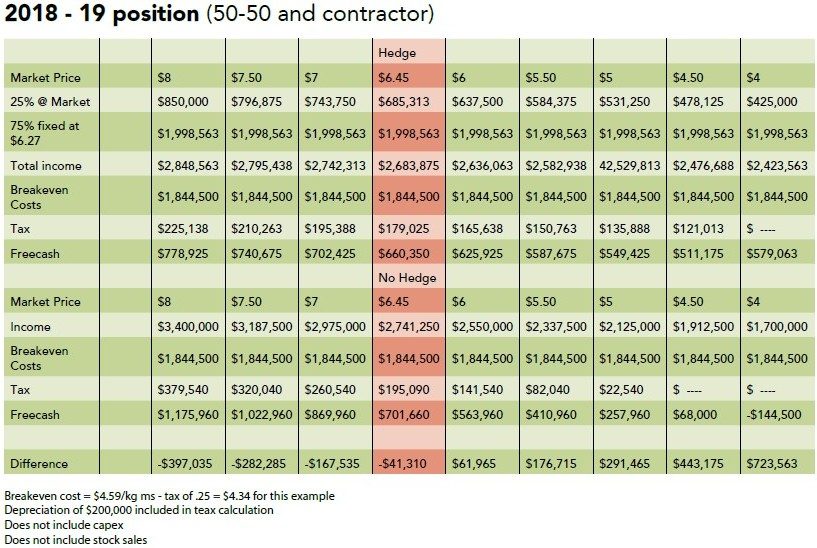

Table one shows the position for the season just finished where 75% of their milk income has been hedged at $6.27 by using a series of hedge contracts bought over time.

At a farm gate milk price of $6.45/kg milksolids (MS) they will have free cash of $660,360.

If they hadn’t hedged at all free cash would have been $701,660 this season so for this particular season they could have been $41,310 better off by not using futures.

If the milk price ended up at $6/kg MS though the hedges would have allowed them to be $61,965 ahead of where they would have been with no contracts.

“The important point is we have achieved our goal, which is to produce $550,000 or more of free cash.”

Fonterra’s wide opening forecast range is an indication volatility is here to stay and just how difficult it is to predict milk price a year out.

While Marv says their strategy has left them short of what they could have achieved without hedging over the past five years it has done what they wanted to achieve in smoothing out their income and delivered their free cash goals.

Over a longer period the negatives and positives are likely to balance out but Marv says by having a good hedging policy he doesn’t expose their business to the rollercoaster ride of high and low profits or even losses.