Achieving high operating returns is critical for dairy farmers maintaining a profitable business. Anne Lee reports.

Early DairyBase numbers show the stark reality of how important it is to strive for high operating profits.

Rabobank’s recent banking report suggesting a slide in land values highlights the point even further.

DairyNZ farm systems specialist Paul Bird says projections based on the latest DairyBase figures show that over the next 10 years the top 20% of North Island farmers, ranked on return on assets (ROA), could grow their equity by more than $1.5 million.

That’s based on a $6.25/kg milksolids (MS) milk price and returning all profits to debt reduction.

Under the same assumptions average performers though will make no headway and could actually see their equity slip by more the $150,000 unless milk prices remain above $6.25/kg MS throughout the period or capital gains return.

The trend remains the same when figures for all regions are included in the analysis although the equity position for the average performer remains stagnant.

It’s important to note too that the projections assume no change in capital property values.

If they slide, the loss of equity is likely to be amplified further for average performers.

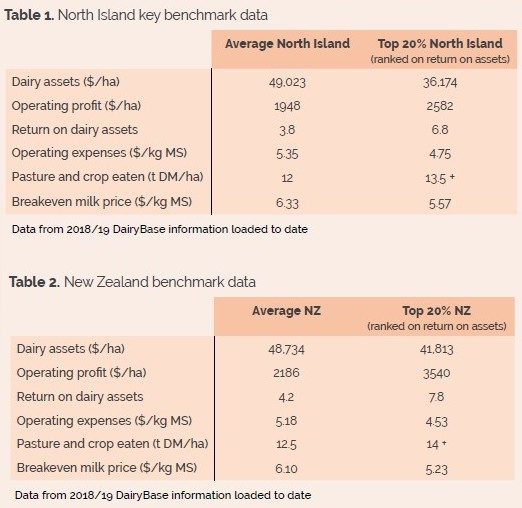

Paul says the figures show the top 20% of North Island farmers have operating expenses of $4.75/kg MS and across New Zealand that figure is $4.53/kg MS.

Paul says the figures show the top 20% of North Island farmers have operating expenses of $4.75/kg MS and across New Zealand that figure is $4.53/kg MS.

The average performers though have much higher costs at $5.35/kg MS in the North Island and $5.18/kg MS when data from throughout the country is included.

The higher costs push breakeven milk price to $6.33/kg MS for the average North Island farmer leaving no room for debt reduction, let alone capital expenses for farm improvements – some of which could be required to meet regulatory requirements.

For top performers the breakeven milk price is $5.57 for North Island farmers and $5.23/kg MS nationwide.

The $6.25/kg MS figure is the long-run average but significant variation around that can occur from year to year.

This season, with the current forecast about $1/kg MS ahead of that, banks are making it clear that in many situations they’ll be expecting the lion’s share of returns above breakeven.

Return on dairy assets for the top 20% sits at 6.8% for the North Island and 7.8% nationally.

There are two sides to that equation with lower costs generating higher returns on one side.

On the other side DairyBase shows it’s also likely those top farmers will have less tied up in dairy assets too, Paul says.

“It takes a lot of skill and you need more things to go right in a more intensive system with a lot of money tied up in infrastructure.

“If it’s not required for environmental or animal welfare needs then you need to question any capital expenditure into infrastructure.”

For those who already have a large investment in infrastructure relative to benchmark they need to be ruthless and look at the return on that asset.

“If you have infrastructure and you’re getting 3-4% ROA then you really need to do a full, thorough review of your whole farm system.

“Can you make it more efficient by buying cheaper supplements, utilising labour more efficiently?

“Get good advice and don’t put it off. It may be that it’s actually better to park that asset up and adjust the farm system.”

‘If it’s not required for environmental or animal welfare needs then you need to question any capital expenditure into infrastructure.’

A ROA of 3-4% is below the cost of capital and not sustainable without capital gain.

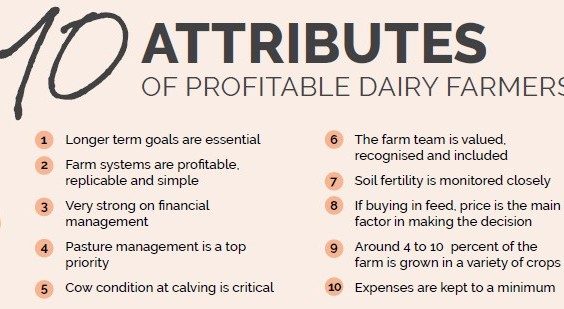

“The overriding factor we do see is that those high performers have very real clarity about how important profit is to them in relation to their goals and purpose for farming.

“You don’t go from average to top by picking one factor like lowering the cost per ME (metabolisable energy) of supplement.

“It’s having that clarity of purpose and discipline to scrutinise the business with that purpose in mind, setting goals, having a clear plan to get there and then monitoring progress with the clear targets in mind.

“I see people who have an overall profit number they’re aiming for but they don’t monitor and I see people who monitor their costs for instance but don’t have clear targets and neither get themselves into that top performance bracket.”

Benchmarking is critical to helping set direction and knowing where efforts should be targeted to achieve improvements.

“I think it’s vital, especially when you start breaking down costs line by line.

“It identifies areas to focus on and what we see with top performers is a willingness to share their information.

“Often we find they get together with other top performers. They’ll sit around the kitchen table and scrutinise financial reports like DairyBase with a fine-tooth comb and it’s those conversations where they challenge and learn from each other.

“Those conversations into why they do a particular thing onfarm that means that cost line is lower, how they do it – that level of detail and discussion is what helps people get to that next level.”

Paul says the data from DairyBase – which benchmarks both key physical and financial performance indicators – continues to show that high profit is generated by high pasture eaten and a focus on cost control.

In the North Island, top performers utilised 1.5 tonnes more of pasture and crop than the average.

“Pasture eaten is the standout driver of profit – we see that year-in year-out.

“There’s a strong relationship with overall operating costs too but if you go line-by-line there’s no one cost area that stands out as the silver bullet.

“They tend to be lower across the board.”

In terms of pasture eaten it comes back to disciplined pasture grazing management skills and setting up the system so that stocking rate matches feed supply.

“There’s a lot of onfarm management that sits behind that.

“It’s getting those basics of good farming right – stocking rate, calving spread, hitting target six-week in-calf rates, achieving target heifer growth rates, being very focussed on pre- and post-graze covers and round lengths.

“When you’re buying in supplement there has to be a disciplined approach to cost.

“Then you have to be able to manage that system year-in year-out through people.

“So again it comes back to clarity so they know what the targets are, what the process is to achieve that and how to monitor progress.

“The simpler the system and the clearer it is the easier it is for that to be repeatable.”

DairyNZ’s budget case study farmers are top performers who share their budgets each year with information and analysis posted on DairyNZ’s website through https://www.dairynz.co.nz/business/budgeting/budget-case-studies/

They have some common characteristics with many relating to their inclination towards having a longer-term view.

While they’re focused on achieving the current season’s goals and plans, they also have eyes on the next season.

They won’t push the limits on the current season to the detriment of next season’s performance, Paul says.

They’re all strong on financial management both in terms of monitoring and analysing their current and future positions.

They make quick, high quality decisions when situations change using sound, scientific and financially astute analysis.