Choice of diversification taken by New Zealand dairy farmers is broad, MyFarm head of investment research Con Williams writes.

The momentum investing that carried the last part of the dairy expansion cycle in search of capital gains has been replaced by farmers looking at value investing once again.

This has involved looking at ways to make existing operations more profitable, while at the same time meeting new environmental and other regulatory requirements. Or it has involved diversification including looking at both land use change opportunities and/or other off-farm investment options.

The chosen path taken is very much related to an individual’s investment personality. This is influenced by a wide range of motivations related to stage of life, risk appetite, knowledge or background experience, personal preferences, passion for the industry, relationships and financial position.

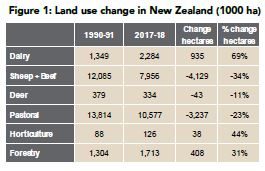

From a land use change perspective it’s still only at the early adopter stage, with a trickle of activity in certain pockets of the country. I say trickle as the expansion of dairy, forestry and urban creep have dominated land use change over the last 30 years (see figure 1). This has come at the expense of the dry stock sectors and pushed horticultural activities (due to urban creep) into other areas.

More recently in Northland it has been popular to convert dairy farms – or parts of – into avocados, kiwifruit and beef finishing. In the Bay of Plenty it’s been kiwifruit, lifestyle blocks and other niche horticultural activities. Hawke’s Bay has been grapes and livestock finishing.

Marlborough/Nelson has seen the development of hops, grapes and other niche horticultural crops out of dairying. Land use change is nothing new and will continue. Right now, forestry and horticulture are capturing the headlines and hearts of farmers diversifying.

Tomorrow dairy could well make a comeback, or something completely new may pop on to the radar. A range of sectoral, business practice and market changes can come together and tilt the playing field.

In the case of the permanent crop sectors the playing field has been tilted through a combination of sector changes and natural advantages New Zealand holds. The common sectoral changes have included a combination of:

In the case of the permanent crop sectors the playing field has been tilted through a combination of sector changes and natural advantages New Zealand holds. The common sectoral changes have included a combination of:

• Creating product uniqueness with trademarked intellectual property.

• Targeting affluent market segments in high-growth Asian countries and traditional Western markets.

• Creation and investment in strong brands that emphasise uniqueness, quality, food safety, first class service and the NZ story.

• Focusing on high margin and growth product categories such as health, wellness and convenience.

• Market-based payments that reflect the quality characteristics most desired by customers.

• The application of best practice management from orchard through to end customer.

• Applying innovations/technologies to key facets of producing, processing, storing and distributing products.

• Integration and collaboration between supply chain participants delivering extra efficiencies, consistent quality and market access to the most desired consumers.

• Strong environmental and social credentials.

The combination used has varied by sector but combined with the natural micro climates NZ has for a variety of crops this has boosted cash returns creating a value investment opportunity.

There have also been lucrative property development margins as the value proposition has turned into momentum investing. For dairy farmers with some knowledge of an existing sector, ready access to skilled expertise, having the right physical resources and climatic conditions (soil type, water and key climatic variables), access to capital to facilitate change, this has offered a chance for financial diversification and increased returns. For those without the right ingredients they have sought partnerships to invest in similar opportunities or looked at other off-farm opportunities.

• Con Williams joined MyFarm in July 2018 as the head of investment research.