You can’t control the weather but you can make sure of the things you can prevent when nature goes awry, By Sheryl Haitana.

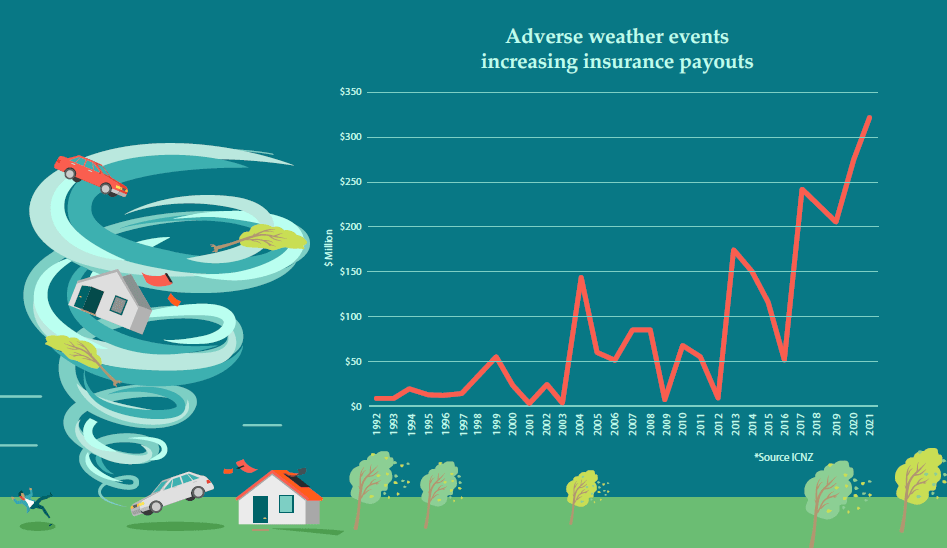

Adverse weather events are on the rise in New Zealand and the disruption fallout they cause to farmers is increasing with pressures on supply chains.

FMG is advising farmers to be extra vigilant around what they can prevent or control and to have a contingency plan for when Mother Nature shows her strength.

Last year was a record payout year for NZ Insurance Council, paying out $304.9 million above the previous record in 2020 of $274m.

For rural insurance specialist FMG, the most significant events in 2021 included the Canterbury floods in which FMG paid out $6.38m, Marlborough/West Coast floods, $6.42m and Canterbury wind storm, $8.5m.The Malbrough/West Coast floods impacted dairy farmers heavily, comprising over 40% of claims. The claims from the windstorm were from almost 40% dairy farms. These adverse weather events are happening more often, says Stephen Cantwell, FMG Head of Client Strategy & Advice Services.

“We are definitely seeing more of these events. It seems there is no region in NZ that’s exempt from Mother Nature.”

The insurance industry as a whole will see the results of climate change first as these events continue to occur, he says.

“For us it shows the importance we will be playing in the future to make sure the NZ agricultural industry continues to be resilient. To make sure we keep preparing for those events is even more important because we expect these to continue.”

“For us it shows the importance we will be playing in the future to make sure the NZ agricultural industry continues to be resilient. To make sure we keep preparing for those events is even more important because we expect these to continue.”

The silver lining of more events occurring is companies like FMG get more streamlined at dealing with them.

“Our people are living in these communities so we can get on the ground quickly and we are well equipped to handle these situations.”

More events puts more pressure on farmers to show resilience and does put more pressure on costs, he says.

Being a mutual insurance company, they have no shareholders to pay, so profit goes back into the company to prepare for the next event and into the 700 sponsorship events FMG supports.

“We are profit-making, not profit-maximising. If we can keep claims down then we can stabilise premiums.

“A big part of why we are here is to make sure insurance is affordable and accessible. We do everything we can to keep it that way.”

FMG is working with farmers to mitigate their risk and concentrate on what they can protect and prevent to control their premiums.

“We can’t control big weather events, but we can control certain events from happening.”

Prevention and protection is more important than it ever has been, for example preventing a tractor fire by carrying out checks, he says.

“Focus on what you can control. You can’t control the weather but you can make sure of the things you can prevent, really focusing on those because of the disruption.”

Make sure you are getting machinery and equipment serviced on time, take an extra couple of hours to go through orientation with new staff to point out hazards, keep a close eye on the chiller during summer months when it is more likely to break down because it’s running under greater pressure, be extra vigilant around rural crime.

Farmers also need to be extra vigilant because it is taking longer for things to get replaced and fixed because of pressure on supplies. FMG is relying on its close relationships with industry groups and local suppliers to help with solutions, replacement and repairs, Stephen says.

“The benefit of FMG is the big network and relationships we have to get things fixed as soon as possible. We can work with the supply chain to move parts around the country.”

Insurance is split into three areas; physical, operational and people. Physical is what people see and think to insure, the house, farm dairy, fences, tractor, etc. Operational is the intangible risks people may not think of. For example if a storm washes out a culvert is on an access track to the farm dairy so cows can’t be milked, which can impact income.

“People don’t always consider the disruption it causes,” Stephen says.

“If your tractor breaks down, and you are using it every day, it can take weeks for a part to get into the country.”

People are the other essential area to consider for insurance. If a farmer or farm employee suffers injury, illness or death, it can have a major impact on the running of a farm. The biggest thing farmers can do outside of insurance is to have a good contingency plan for if or when things go wrong, Stephen says.

“It happens more often than you think.”

FMG advisers work with farmers to ensure they are prepared with insurance cover, as well as contingency plans for when the unexpected happens.