By Stuart Davison

By the time you read this article, the NZX (New Zealand Exchange) and the SGX (Singapore Exchange) would have completed the transfer of NZX Dairy Derivatives from NZX to the biggest exchange in Asia, the SGX, completing a real boon for the NZ dairy industry, which has probably flown under the radar here at home.

Obviously, this effort was not missed in our offices, as the NZX Dairy Derivatives team has tirelessly worked to complete the transfer. But, I know what you’re asking; how is this a boon for the NZ dairy industry?

Well, let’s start by pointing out a few key points; our biggest region of dairy customers (or, end users) is Asia, which includes China and all of the other key South East Asian regions.

China on its own consumes 41% of NZ dairy exports, and this trend is unlikely to change in a hurry. NZ historically has been completely exposed to commodity trend cycles, without any way to protect the industry from shocks that usually come from commodity production; think 2013- 2014 price rise and crash. This is where financial instruments such as futures and option contracts come into the picture.

I’m sure you’ve heard of the concept of “hedging your risk”, well this is one of the key concepts of having a derivatives market.

This market is a place where buyers and sellers of a certain commodity can buy and sell a financial contract, tied to the underlying physical commodity, for a certain price agreed upon now that will trade at a determined time in the future. This “hedges” both the buy and sell side’s risk before the actual trade occurs; aptly named futures contracts.

Futures contracts, which are financial derivatives, use this basic concept to help manage risk for those within certain industries. There are derivatives for almost everything you can imagine, ranging from sugar to coffee, oil to currency.

Now back to how moving dairy derivatives to SGX is a boon for the NZ dairy industry. Local dairy processors, Fonterra etc, and end users, such as Mengniu in China, use these contracts to mitigate their individual risk exposure to the price movements of the underlying commodity.

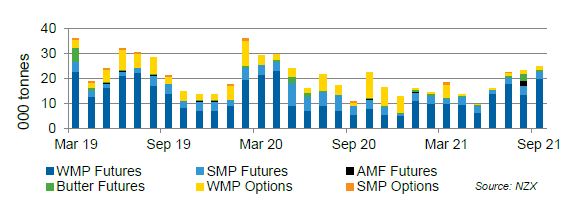

Whole milk powder (WMP) futures contracts are the most traded dairy derivative on the NZX market, which is also NZ’s biggest dairy export. Moving this market to the SGX exposes the contracts to more brokers, more speculators and closer to more end users, helping to balance the demand and supply for these contracts better.

For a company like Fonterra, the ability to manage risk with a derivatives market is paramount to reducing their overall risk exposure.

Everyone gets bogged down with Fonterra’s currency trading, but that is only one part of Fonterra’s overall derivative uses. So, if more buyers of WMP are willing to also engage in using WMP futures contracts, then Fonterra can increase the volume of risk that it can mitigate, while the buyer can also mitigate their own risks.

This creates a much more stable marketplace, as buyers and sellers are both more engaged in price discovery.

This market also creates a forward view of prices, as both buyers and sellers trade for timeframes into the future, giving a forward view of intentions of both sides of the market.

Speculation is also a key part of a derivatives market, where speculative traders aim to make profit from picking which way the market is heading. Speculation trading in a derivative market is like grease on a silage wagon, they help to keep things moving, creating liquidity within the market, or the speed or quantity of trades within a market. By nature of its size, and financial maturity, the SGX has more speculative traders than here in NZ.

As the NZX Dairy Derivative market moves to the SGX, all of these facets combine to create a set of financial instruments with more liquidity and closer to industry end users, that will help to de-risk the dairy industry, as uptake and use of these instruments grows.

The boon for the industry comes from increased price stability, a forward view of the market, along with derivative products that can be used onfarm, such as milk price futures, that will allow for risk management from every point in the production chain; the farm gate to the factory floor in China.

All in all, a great step forward in maturing the NZ dairy industry, and growing resilience to price shocks into the future.

- Stuart Davison is an NZX Dairy Analyst.