Prices are expected to remain at historical highs for the remainder of this year, but Mel Croad expects further pricing pressure at the farmgate from early 2023.

LAMB PRICES HAVE BEEN EXCEPTIONAL this season, from the store market to the finished market, allowing everyone to enjoy the stronger returns. As this season wraps up and lambing remains in full swing, the focus switches to what the new season could entail and where prices are likely to track.

High returns this season stemmed from the global recovery in the food service sector, which started in April 2021. Markets concerned about food security set about absorbing as much product as they could. This led to strong export values and a subsequent lift in lamb prices.

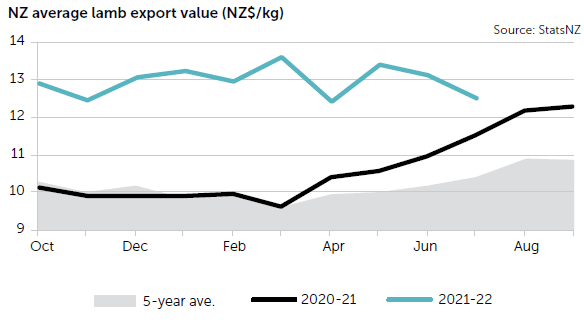

Average export values for lamb tend to peak in early spring, but last year that rally continued into the shoulders of the season. After bottoming at $9.61/kg in March 2021, average export values for New Zealand lamb climbed by a whopping $3.43/kg by December.

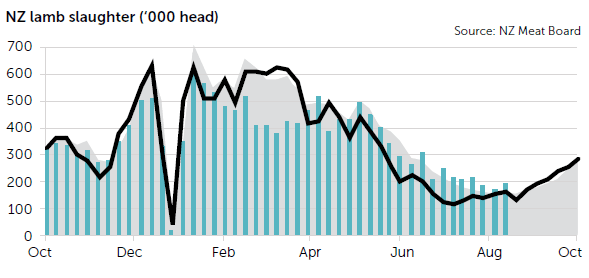

A cold wet spring in areas renowned for early drafts of lambs last year started a chain reaction of tighter supplies and this continued into early 2022 where it switched to the inability to get lambs into processing plants as Covid-19 infection rates soared and staff were forced to isolate.

Not to be outdone, average export values lifted further through the opening stages of 2022. It is very unusual to see values lifting at that point of the season. Much of this was a result of massive disruption at a NZ processing level and a subsequent lack of production.

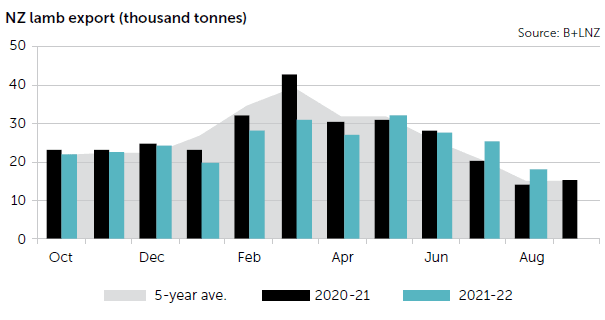

Slaughter graphs show a gaping hole in production through the early stages of 2022. It has only been since June that processors have been in a position to claw back some of the deficit. These swings in supply have resulted in tighter exports leaving NZ. Season to date, covering the first 10 months of the season, NZ has exported 259,000 tonnes of lamb. This compares with 280,000t over the same period last season.

Lamb markets weaker than 2021

While this worked in our favour earlier in the season, the global economic environment has swung more negative in recent months. With lamb a premium protein and already highly priced, it has come up against some pricing resistance within key markets, in stark contrast to 12 months earlier. This started in China as they swung in and out of Covid-19 lockdowns. It has since swept through Europe, the UK and North America. Asking prices for NZ lamb cuts are in many cases lower than exporters were receiving this time last year. However, that’s not immediately clear when simply relying on average export value data.

Recently released figures for July show values still in excess of this time last year, which on face value contradict the softer market conditions at play. This is because the weaker NZ dollar is doing a fine job masking true market conditions. The NZD has been yo-yoing between US60–64c in recent months. This compares with US70–71c a year ago. So while returns in NZ$ terms remain at near record highs, when omitting the exchange rate benefits, and viewed in US$ terms, July’s result dropped below US$8/kg for the first time in more than a year.

Recently released figures for July show values still in excess of this time last year, which on face value contradict the softer market conditions at play. This is because the weaker NZ dollar is doing a fine job masking true market conditions. The NZD has been yo-yoing between US60–64c in recent months. This compares with US70–71c a year ago. So while returns in NZ$ terms remain at near record highs, when omitting the exchange rate benefits, and viewed in US$ terms, July’s result dropped below US$8/kg for the first time in more than a year.

Driving much of the market weakness in recent months has been the softer values out of China. These basically started unravelling towards the end of last year but have gathered more momentum in recent months. The drop off in export volumes hasn’t encouraged any upside in asking prices either, indicating their demand for lamb is much softer than through 2021.

Fortunately, partially offsetting some of the weakness visible in the Chinese market has been a return of our more traditional markets, through Europe, United Kingdom and the United States. These key markets combined have stepped up to the plate, not only demanding more NZ lamb but also paying higher prices to secure it.

Fortunately, partially offsetting some of the weakness visible in the Chinese market has been a return of our more traditional markets, through Europe, United Kingdom and the United States. These key markets combined have stepped up to the plate, not only demanding more NZ lamb but also paying higher prices to secure it.

Some of this comes down to the higher value of the cuts exported to these markets. In many cases they are boneless cuts, and with staffing shortages at a processing level, these more labour-intensive cuts have attracted premiums due to their tighter availability. However, even these prices are now getting the speed wobbles.

Where to from here?

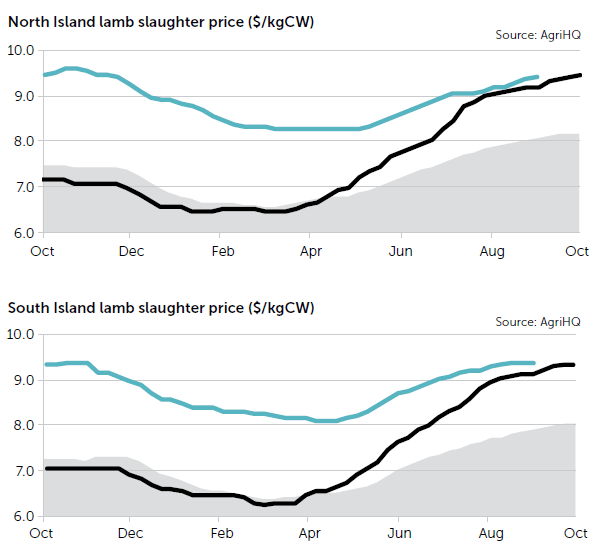

A few pricing contracts scattered across the country give some indication how this season will wash up in terms of pricing. AgriHQ data shows average lamb returns in the North Island for the season will be close to $8.90/kg or a bit above. This compares with $7.52/kg for the entire 2020/21 season. In the South Island, prices look set to average $8.80/kg for the season, compared to $7.33/kg for last season.

The 2022/23 season will kick off October 1 with a nine in front of prices, much like last year. The odd contract out to Christmas suggests pricing should hold up well over the balance of 2022. But that will be dependent on all meat processors holding a similar outlook in terms of pricing intentions and overseas demand continuing to support these expectations. To compare, by Christmas last year, AgriHQ lamb slaughter prices were averaging $8.95/kg in the North Island and $8.60/kg in the South Island.

The 2022/23 season will kick off October 1 with a nine in front of prices, much like last year. The odd contract out to Christmas suggests pricing should hold up well over the balance of 2022. But that will be dependent on all meat processors holding a similar outlook in terms of pricing intentions and overseas demand continuing to support these expectations. To compare, by Christmas last year, AgriHQ lamb slaughter prices were averaging $8.95/kg in the North Island and $8.60/kg in the South Island.

Usually as the new export season gets under way, exporters are busy securing supplies to meet commitments for both the Christmas chilled lamb trade and Chinese New Year buying. There are indications that demand from Christmas chilled lamb may not be as strong this year.

Exporters have shied away from focusing too hard on the chilled market this season. The risks involved in ensuring product gets to market before the shelf life is compromised has been too great for many. Fortunately, frozen prices have been strong enough to help bridge the gap between the two market sectors, but it’s unknown if this will remain the case. Also, traditional Christmas chilled markets appear full up within inventories which will also slow sales.

Exporters have shied away from focusing too hard on the chilled market this season. The risks involved in ensuring product gets to market before the shelf life is compromised has been too great for many. Fortunately, frozen prices have been strong enough to help bridge the gap between the two market sectors, but it’s unknown if this will remain the case. Also, traditional Christmas chilled markets appear full up within inventories which will also slow sales.

Chinese New Year buying will also get under way earlier this year, due to their earlier celebration timeframe starting in January 2023. This means ships need to be loaded with NZ lamb and on the water by early December. If lamb slaughter rates return to normal trends through this period, this earlier buying period should support the increased production. However, as mentioned earlier, lamb exports to China have been far from breaking records recently. Between October 2021 and July 2022, China imported just over 100,000t of lamb from NZ. This is a reduction of more than 40,000t on the previous season and 13,000t short of five-year average volumes.

The flow of new season lambs into processing plants is also expected to be different to last season. Most of the early drafting regions were hammered by a cold and wet spring last year, which impacted growth rates and yields. This led to significant numbers of lambs being held over into the new year.

While winter this year has been very wet, plenty of farmers are banking on good spring grass growth, which should enable a return to decent numbers of lambs for processing this side of Christmas. No one wants to be caught with extra lambs on farm going into January. However, while seasonal conditions may allow for faster finishing rates, throughput at processors remains at the mercy of staffing numbers. It will be key to lock in space through this part of the season. Backlogs could eventuate even if numbers aren’t as big as normal.

Expect the usual seasonal downside in pricing to eventuate, but it will remain at historical highs over the remainder of the year. This is purely because it will begin reducing from a much higher starting point. But AgriHQ expects further pricing pressure at the farm gate from early 2023, particularly if global economic conditions put further strain on the lamb demand and pricing as our supplies ramp up.

- Mel Croad is a senior analyst with AgriHQ.