Reducing reliance on internationally produced feed

NZ livestock systems are reliant on internationally produced feed. This represents a risk especially to the profitability and sustainability of the dairy industry. By Raewyn Densley, Jeremy Hunt, Lauren McEldowney, Phil Journeaux, Julian Reti Kaukau.

New Zealand is a net importer of grain and feed of which 75% is consumed by the dairy industry. A recent Our Land and Water project investigated the many factors which impact global grain and feed price and supply, quantified NZ’s arable industry and identified opportunities to grow more grain or alternative livestock feeds locally.

It also modelled the economic and environmental implications of NZ dairy farms reducing stocking rates and growing more home-grown feed.

Each year the world produces about 2.7-2.9 billion tonnes of grain, but only 17% is traded internationally. Key exporting regions are Europe and North America whilst Asia and Africa are net importers.

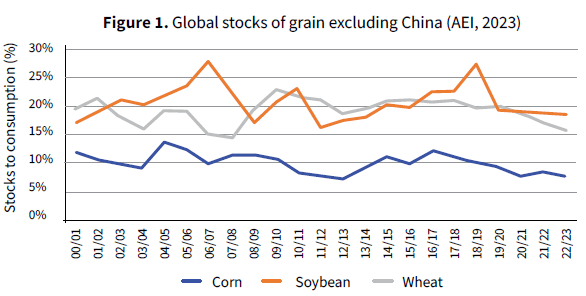

The stocks-to-use (S/U) ratio indicates the level of carryover stock for any given commodity as a percentage of the total global use of that commodity. Higher stock-to-use ratios mean more supply is available while lower ratios suggest a tighter supply situation.

Global grain stocks are surprisingly low with S/U ratios of around 30-35% for wheat and 20-25% for maize. In 2022/23, China held 70% of global maize grain stocks, 32% of soybean, and 54% of wheat. If Chinese stocks are removed, the S/U ratio of wheat and soybeans is below 20% and maize (or corn) is below 10% (Figure 1).

Human food, livestock feed and more recently, biofuel production all compete for a relatively small pool of surplus grain, and supply and demand are impacted by a wide range of climatic and geopolitical factors.

In 2022 global grain prices reached n all-time high and this could be attributed to a number of factors including the Covid pandemic, droughts in Europe and parts of the United States, increasing Chinese demand and stockpiling of grain and the Russia-Ukraine war.

New Zealand’s arable industry

On a global basis the NZ arable industry is small, producing about 900,000t of grain on 107,000 hectares. Most (67%) arable cropping occurs in Canterbury although there are small areas in most regions. While yields are high, so are production costs and inter-island freight rates. This means it is often cheaper to buy grain from overseas than it is to source it from local producers, especially if it has to be moved between the North and South Island.

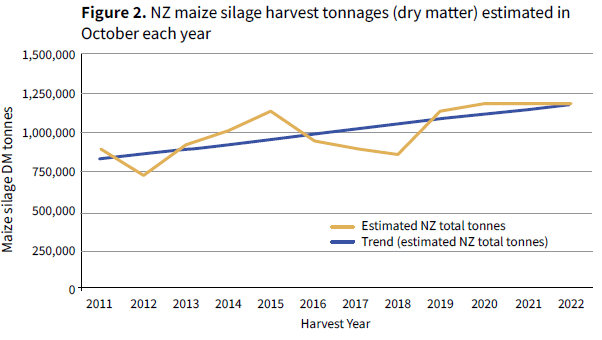

Maize silage is a popular crop throughout the North Island and upper South Island and a significant amount of maize silage is grown on arable farms and sold to dairy farmers. In 2022 an estimated 57,266ha of maize was planted for silage producing a total of 1.19 million tonnes of drymatter (DM) (Figure 2).

Internationally produced feed (IPF)

Internationally produced feed (IPF)

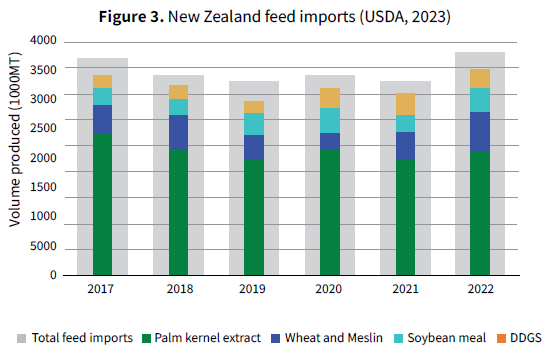

NZ is a net importer of grain and concentrates with imports rising to a record level of 3.7m tonnes in 2022 (Figure 3). The dairy industry is the largest consumer taking 75% of all feed imports with poultry consuming 12% and other livestock 4%. Palm kernel, sourced from Malaysia and Indonesia, is the highest volume feed supplement and is predominately fed to dairy cows. In 2022 NZ imported 1.97m tonnes of palm kernel (1.78t DM) representing about 54% of total grain and feed imports.

How likely is a shortage of IPF?

Grain of varying types is produced in many countries which means there are multiple harvest events each year. Australia is a large producer exporting more than 40 times the annual NZ demand for imported grain. For these reasons there is a low risk NZ would be unable to source grain, albeit at a higher price.

In contrast, Malaysia and Indonesia produce more than 80% of the world’s palm oil and they export 93% of palm nut or kernel oil residues (including palm kernel). While the oil palm is a uniquely productive crop, there is growing Western consumer resistance to its use for health, environmental and socio-economic concerns.

Laboratory-developed single-cell yeast oils could play an important role in reducing global dependence on palm oil. The first products have already been launched including Palmless™, a body oil produced by Bill Gates-backed biotech company C16 Biosciences.

Changes in consumer preferences away from palm oil could slowly reduce the supply of palm kernel. Extreme weather events, pests and diseases, labour shortages, geopolitical instability or conflict and variations in government policy could have a larger and more rapid impact on NZ’s ability to source it.

NZ imports enough palm kernel to meet the total feed requirement of about 8% of the nation’s dairy cows. A shortage could impact production and cow condition score.

Ultimately farmers would need to destock but there could be challenges with culling of surplus animals especially if the shortage coincided with a local adverse weather event which impacted pasture growth, or at a time of the year when meat processing facilities were already working to capacity.

How can NZ be less reliant on IPF?

How can NZ be less reliant on IPF?

While pig and poultry demand for grain is likely to remain stable, dairy demand for supplements and IPF is predicted to increase as farmers attempt to drive higher per-cow performance and seasonal pasture growth rates, and possibly feed quality are impacted by climate change.

The recently introduced Intensive Winter Grazing (IWF) regulations and the 190kg N/ha nitrogen cap are also expected to increase the demand for bought-in feed. NZ can decrease its demand for IPF by growing more grain, decreasing dairy demand for bought-in supplements, or a combination of both.

Growing more grain

Growing more grain

While local grain yields are high, there is a significant gap between top and average producers. Further work is needed in the arable sector to identify key onfarm limitations to yield and address them. Growers could likely increase grain yields by fine tuning their management practices and improving the timeliness of cropping operations. Adoption of precision farming techniques which allow farmers to identify and address yield-limiting factors within a crop management zone has the potential to increase yield and production efficiency.

Opportunities exist to grow more grain on whenua Māori, lifestyle blocks and sheep and beef farms which have suitable contour and soils. Smaller, less-economic dairy farms or those on the cusp of requiring additional labour or wishing to avoid an infrastructure upgrade (e.g. a larger farm dairy or effluent system) also represent an area for potential arable growth.

Reducing dairy farm demand for IPF

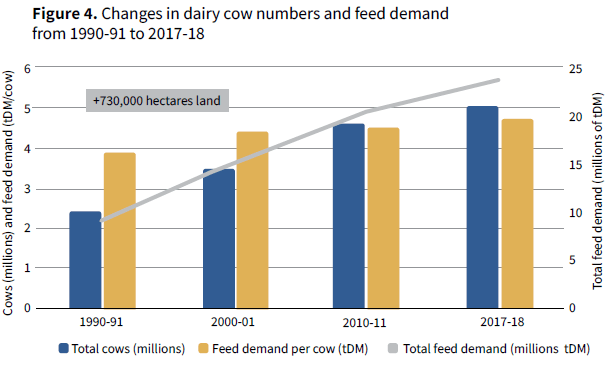

The NZ dairy industry is the largest consumer of internationally produced feed (IPF). Dairy cow numbers increased from about 2.4 million in 1992-93 to a peak of 5.0m cows in 2017-18. During this time more than 730,000 additional hectares were converted to dairying.

Over approximately the same period, average per-cow production lifted from about 259kg milksolids (kg MS)/cow to 397kg MS/cow (53%) and stocking rates rose 18% from 2.43 to 2.86 cows/ha (Figure 4).

The dairy industry’s demand for more feed has been met by more land and more homegrown and imported (including IPF) supplements. The compound annual growth rates for supplements have been 5.6% for harvested supplements (e.g maize silage and barley), 5.6% for grown crops (e.g. beet, kale, swedes) and 9% for imported feeds including palm kernel.

Dairy farm modelling

Dairy farm modelling

A potential way for dairy farmers to decrease demand for IPF is to reduce stocking rates and grow more onfarm crops.

To model the impact of varying supplementary feed management strategies, five base whole farm models were created using Farmax and OverseerFM.

The models represented an ‘average farm’ of flat to rolling

contour in Northland, Waikato/Bay of Plenty, Taranaki, Canterbury, or Southland. A number of DairyNZ reports were used to determine typical supplementary feed use and this varied between regions and included a mix of home-grown and bought-in feeds.

To establish the economic and environmental differences, two additional scenarios were modelled for each region. These were Scenario 1 and 2.

Financial parameters used in the FARMAX models included a milk price of $7/kg MS and a urea price of $1300/tonne. The costs for homegrown supplements were pasture silage ($200/t DM), maize silage ($4000/ha stacked), bulb turnips ($1800/ha) and fodder beet ($3150/ha). Imported feed costs included concentrates ($500/t DM), maize silage ($450/t DM) and pasture silage ($400/t DM)

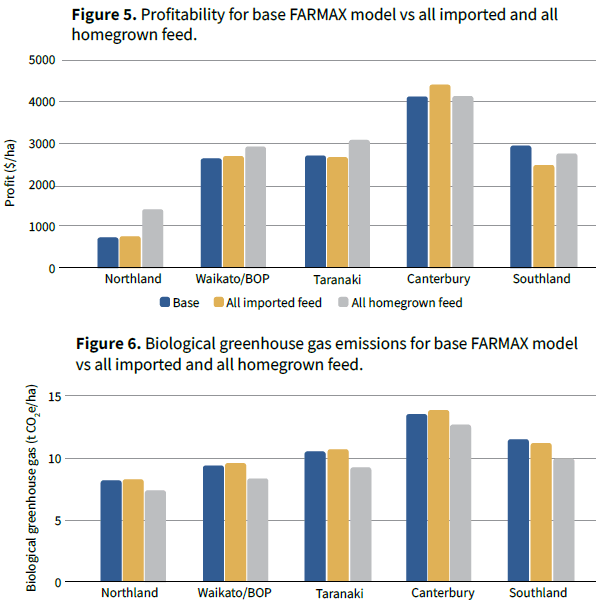

Compared to the base model, reducing stocking rate and growing all feed onfarm resulted in substantially lower feed costs and 5-14% lower milk production. Farm profit was higher in the three North Island regions, the same in Canterbury and lower in Southland (Figure 5).

A sensitivity analysis was conducted for Waikato and Canterbury using concentrate prices of $400 to $600/t DM and milksolids prices from $6.00 to $8.00/kg MS. It highlighted regional differences in the profitability of growing all feed (Scenario 2) versus buying in all feed (Scenario 1).

In Waikato, growing all feed onfarm was more profitable than buying it in except when the milk price was above $8.00/kg MS and the supplement price was below $500/t DM delivered. For most farmers this equates to a price of close to $400/t for concentrate ex-works. In Canterbury it was more profitable to grow all feed onfarm when the milk price was $6.00, and the concentrate was $450/t DM or higher. At higher milk prices, it was marginally (0 to 5%) more profitable to have a higher stocking rate and buy in feed.

When compared to the regional base scenarios, Scenario 2 (all home-grown feed) decreased N loss to water slightly in three regions but increased it slightly in two regions.

Across all five regions, the base scenarios had an average biological GHG emission of 10.57 tonnes of carbon dioxide equivalents per hectare (tCO2e/ha) of which 80% was methane and 20% nitrous oxide.

Using all home-grown feed reduced the average biological GHG emission to 9.46t (tCO2e/ha) of which 79% was methane and 21% nitrous oxide. The reduction in biological GHG was lowest in Canterbury (6%) and highest in Southland and Taranaki (13%). The reduction in GHG emissions from using a lower stocking rate and home-grown feed will have a positive impact on profitability once farmers have to pay for their emissions.

Fonterra have already recognised destocking and onfarm cropping as a means of reducing onfarm GHG emissions and this modelling work supports their strategy while at the same time decreasing dairy farm demand for IPF.

In summary, NZ livestock systems are reliant on internationally produced feed. This represents a risk especially to the profitability and sustainability of the dairy industry. Increasing grain yields, bringing more land into grain production and transitioning to dairy farm systems which utilise more home-grown feed are all ways we could reduce our reliance on IPF.

Scenario 1 (all imported feed) modelled removing all home-grown crops (excluding home grown pasture silage) and replacing them with imported feed. Cow numbers (stocking rate) did not change.

Northland and Taranaki had summer crop turnips replaced with imported maize silage and palm kernel. Waikato/BOP had home-grown maize silage replaced with imported maize silage and palm kernel. Canterbury had home-grown fodder beet replaced with imported maize and pasture silage. The Southland base model had no home-grown crops; however, the whole herd was wintered off for nine weeks. In Scenario 1 for Southland, the whole herd was wintered onfarm and additional pasture silage, hay, barley grain, and palm kernel imported.

Scenario 2 (all home-grown feed) modelled removing all imported feed and replacing it with home-grown feed/crops. Cow numbers (stocking rate) were reduced to ensure opening and closing BCS of the herd and pasture covers were the same as the base models and BCS and pasture trends (month ends) throughout the season were as similar as possible to the base models.

For Northland, summer crop turnips and maize silage was grown, and total cropping area was increased from the initial base models, while the number of cows wintered off was reduced.

For Waikato/BOP, and Taranaki, summer crop turnips and maize silage was grown, and total cropping area was increased from the initial base models.

In Canterbury, an increased area of fodder beet was grown, and an additional crop of maize silage grown from the base model. The same number of cows were wintered off as the base model.

For Southland, the whole herd was wintered off for nine weeks as in the base model. This was due to the base model not growing winter crops and the Intensive Winter Grazing (IWG) regulations which cap the area of winter grazed crops at current levels. A summer crop of oats was grown for cereal silage.

For the purposes of the model, it was assumed no capital investment in infrastructure was made. Maize and pasture silage were fed out in the paddock (no feedpad) with an assumed utilisation of 80%.

- The authors wish to acknowledge Our Land and Water for funding this project through their Contestable Fund. We also thank all those who gave their time to assist us with our research.