Anne Lee

NZX’s new milk price futures and options market launches later this month, allowing Kiwi farmers to lock in a milk price but how does it work, what are its benefits and what are some of the pitfalls to be aware of?

The market has the potential to reduce farmers’ income risk and even out what have been highly volatile returns with many seeing it as an alternative to Fonterra’s now-scrapped guaranteed milk price (GMP).

While GMP drew criticism from some for being somewhat complex – particularly when it came to the process for securing a contract – there’s no doubt what farmers now have in the new futures and options contract takes that complexity to a whole new level. So it’s not going to be for everyone, and even those with a vested interest in it are quick to point out participants must be comfortable they understand it and be fully aware of the possible outcomes before they make a trade. Farmers will be able to trade a futures or options contract only through an accredited or approved company, with those companies obliged to ensure their clients understand the contract.

Currently there are two NZ-based firms accredited to participate in the NZX derivatives markets – First NZ Capital and OMF, and several international firms. Accredited firms will be listed on

NZX’s website. Mike McIntyre is head of derivatives at First NZ Capital, and says while it’s early days the farming entities he’s talked to see the new milk price futures product as an appropriate price risk management tool and are working on coming to grips with the details.

There’s also an increased awareness that NZ dairy farmers, and in particular Fonterra suppliers, are wide open to milk price volatility.

Lifting the level of understanding specifically around the new milk price futures and options products as well as raising general awareness of how the markets operate is imperative, he says.

OMF director of financial markets Nigel Brunel, pictured, says he’s fielding several phone calls daily from farmers wanting more information and describes the level of interest as high.

Some had used Fonterra’s GMP but there were plenty who hadn’t. Some were large scale enterprises and some were smaller.

The Fonterra Shareholders’ Council nationwide Grow Your Minds seminar series last month piqued farmers’ interest in price risk management and had many seeking further understanding of how futures and options could be used as a tool. Brunel says OMF will be running seminars around the country for farmers interested in learning more, starting with seminars held twice daily at the Fieldays at Mystery Creek in June.

Milk price futures 101

A futures contract is a legally binding contract to buy or sell a specific quantity of something in the future but at a price that’s agreed at the time the arrangement is made. In the case of NZX’s milk price futures each contract is for 6000kg milksolids (MS).

The contracts are bought and sold on a financial markets exchange – in this case the NZX derivatives market – and no physical delivery of milk takes place. Instead the market is cash-settled with

the settlement price or price the contract will be worth at the future date based on the real value of the underlying physical good the future relates to.

In the case of NZX milk price futures that settlement price is Fonterra’s announced final farmgate milk price each year. The milk price futures contract therefore settles once a year, with NZX setting October 3 as the annual settlement date.

A farmer who wants to hedge their milk price risk will take part in the market by agreeing in advance to sell a futures contract at the time of settlement. The price agreed when the contract is taken out is the price the farmer will receive at the time of settlement.

The cost of the contract (settlement price) is taken off the sale price and the farmer will receive, or have to pay, the remaining funds. If the settlement price-Fonterra’s final milk price is less than the futures contract price the farmer agreed to he or she makes money on the trade.

If the settlement price-Fonterra’s final milk price is more than the futures price, the farmer will lose money on the trade and be required to part with cash to the value of that difference.

As an act of good faith to ensure trades are completed those participating in the market are required to make a deposit to a “margin account”.

The amount required as a deposit is a percentage of the contract value and is commonly about 5-15%. Additional funds might have to be deposited into this account if the trade is moving against the contract holder. (See Margin accounts: the lowdown for more information.)

The key principal in futures trading is that any gain or loss in the financial futures market will offset a loss or gain in the physical market thereby setting a fixed price or a hedged price.

How it works in practice

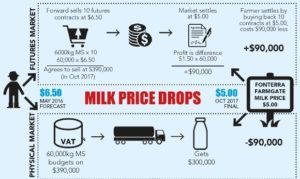

A farmer who produces 60,000kg MS decides to hedge all his milk and in May this year enters into 10 milk price futures contracts (10 x each contract for 6000kg MS) agreeing to sell the contracts at time of settlement (October 2017) for $6.50/kg MS.

A farmer who produces 60,000kg MS decides to hedge all his milk and in May this year enters into 10 milk price futures contracts (10 x each contract for 6000kg MS) agreeing to sell the contracts at time of settlement (October 2017) for $6.50/kg MS.

Over the season, milk price drops to $5/kg MS which is $1.50/kg MS less than he had budgeted for at the start of the season. NZX has said the milk price futures contract will settle to Fonterra’s final announced milk price which means that’s what the contracts will be worth.

But our farmer has contracts to sell his futures at $6.50/kg MS so he makes a gain on the futures market of $90,000 or $1.50/kg MS x 60,000kg MS.

On the farm he’s received only $5/kg MS when he’d budgeted for $6.50 so his total milk revenue was $300,000 not $390,000.

The $90,000 less he made on the farm is counteracted by the $90,000 gain he made on the futures market and overall his total income ends up at the equivalent of $6.50/kg MS.

But what happens if milk price goes up during the season and the futures contract is worth less than the final milk price?

But what happens if milk price goes up during the season and the futures contract is worth less than the final milk price?

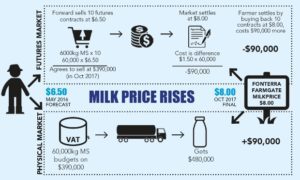

The farmer in figure two enters into an agreement to sell 10 milk price futures contacts at $6.50 so will receive $390,000.

At the end of the season the settlement price and Fonterra’s final announced milk price is $8/kg MS which means the farmer has lost out on $1.50/kg MS or $90,000. But on the farm he’s received $8.50/kg MS or $480,000.

When he subtracts his loss on the futures market his net income is $390,000 so overall his milk price ends up at $6.50/kg MS.

In both examples the farmer has locked in a milk price of $6.50/kg MS even though the milk price moved up or down $1.50/kg MS.