Whole milk powder slumps

With extra volumes on the auction and excess supply in the global market, it was unsurprising that a decline in demand for whole milk powder occurred. By Alex Winning-Brown.

It’s been a tough couple months for dairy commodity prices through the start of Q3.

The first Global Dairy Trade (GDT) auction for August saw a 4.3% decline to the overall index price while the second followed with a 7.4% decline.

Despite the overall declines, it has been whole milk powder (WMP) that the globe is watching. For August, WMP has slumped 17.8%, hitting the sub US$2600/tonne floor price that has held for nearly five years. With extra volumes on the auction and excess supply in the global market, it was unsurprising that a decline occurred for the commodity, however, it was surprising to the extent.

Let’s dig a little deeper into the supply side.

China had reported five consecutive months of increases in milk production through the start of 2023, doubled with a lacklustre return of demand post-Covid, the nation has been swimming in milk powder supply for some time, importing significantly less and driving little demand in commodity prices globally.

June, however, saw China’s first decline in milk production for the year, below both 2022 and 2021 year-on-year. With a strong start to the year, Chinese milk production remains up by 2.8% on the year to date.

New Zealand supply was strong through the previous season with an 8.4% increase in May bringing the whole season to a surprising 0.2% increase. The wet weather that supported summer and autumn however, has had an impact on winter, with June’s figures posting a 0.2% decline.

Figures haven’t been released for July yet, but we are also anticipating a slight ease albeit, June and July being the smallest milk production months of the season. Despite a slow start to the season, with low demand out of NZ’s largest dairy export partner (China), there is still inventory left to clear.

The United States and Europe have also managed to stay afloat in milk production despite unfavourable weather in parts, and with inflation affecting their domestic markets, both regions are also swimming in dairy inventory.

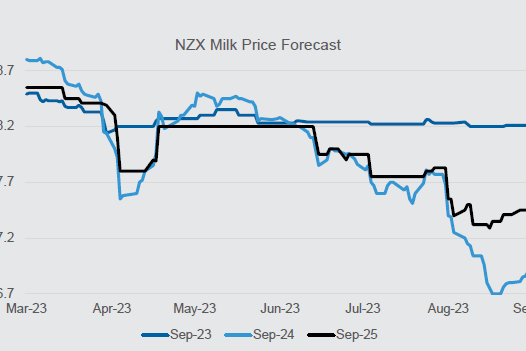

Looking forward, supply is likely to tighten. The impact of low dairy prices on the Fonterra Farmgate Milk Price is hurting farmers’ margins, with $1.25/kg milksolids (MS) taken off the forecast over the last two weeks to the current forecast of $6.75/kg MS. The NZX forecast for the season sits slightly lower at $6.63/kgMS.

Reports around the country suggest farmers are looking to reduce feed and fertiliser to mitigate cost, with expected declines in production as we head into the spring peak months.

With drought continuing through Europe and looming hurricanes heading towards the US, there is also speculation about the steadiness of their milk production. And there is further speculation on the continuation of China’s milk production dipping further as the country suffers economic woes and increased farming costs.

In addition to the supply deficit, recent news out of China suggests their government intends to boost domestic consumption through stimulus, giving hope to dairy demand lifting.