Wider impacts of alternative proteins

The growth in supply of alternative proteins is likely to have a marked effect on global protein markets and prices. Words Anne Lee.

A s part of the Our Land and Water National Science Challenge, a research project has looked at what impacts an increasing demand for alternative proteins could have on New Zealand’s primary sector, the economy more generally and the flow-on effect for environmental factors.

The Protein Future Scenarios project modelled three plausible future scenarios as well as a more conservative baseline scenario for the main alternative protein technologies:

- Plant-based proteins – used to create meat and milk alternatives. The proteins are extracted from plants such as legumes and grains but can include foods such as tofu, produced from soybean.

- Cell-cultured proteins – lab-grown proteins created by extracting cells and replicating them in a laboratory environment. The end products are genetically identical to the original cells and can be used to make meat products.

- Fermented protein – produced using precision fermentation techniques that genetically modify yeast to replicate specific proteins in dairy.

The 4 scenarios modelled included:

Scenario 1 – a baseline situation where the alternative proteins only marginally impacted on traditional protein supply chains with issues such as technical barriers, scaling production and lack of consumer uptake causing a slower growth in the alternative proteins. That scenario isn’t deemed likely given current interest and commercial development, but is used to provide a point of comparison.

Scenario 2 – precision fermentation takes off and demand for plant-based milks increases by 22% or more. Demand for plant proteins continues (+10%) but technical issues stall the development of cell-cultured products. Sustainability helps drive consumer acceptance with improved taste and texture and price parity also playing a role in increased consumer appeal.

Scenario 3 – plant-based protein demand takes off (+22%) while some of the barriers facing precision fermentation and cellular products are removed leading to growth in their demand too (+10% for each). Again, sustainability is a key factor.

Scenario 4 – all alternative proteins take off. Demand for each protein grows by +22%. All current barriers to success are removed, the scale of production increases and price parity is achieved. Taste and texture improve. Sustainability is a significant factor and alternative proteins are viewed as solving several global concerns.

Modelling outcomes for 2050

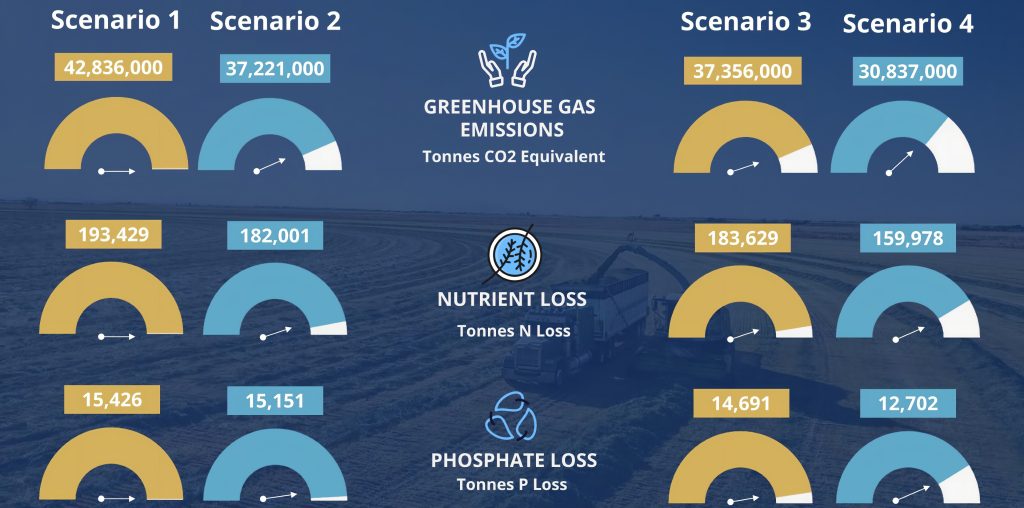

Environmental impact

Greenhouse gas (GHG) emissions, nitrogen loss and phosphate loss are all lower for scenarios two, three and four compared with scenario one.

The greatest reductions come from scenario four with a 28% drop in GHG emissions, a 17% drop in nitrogen loss and an 18% fall in phosphate loss.

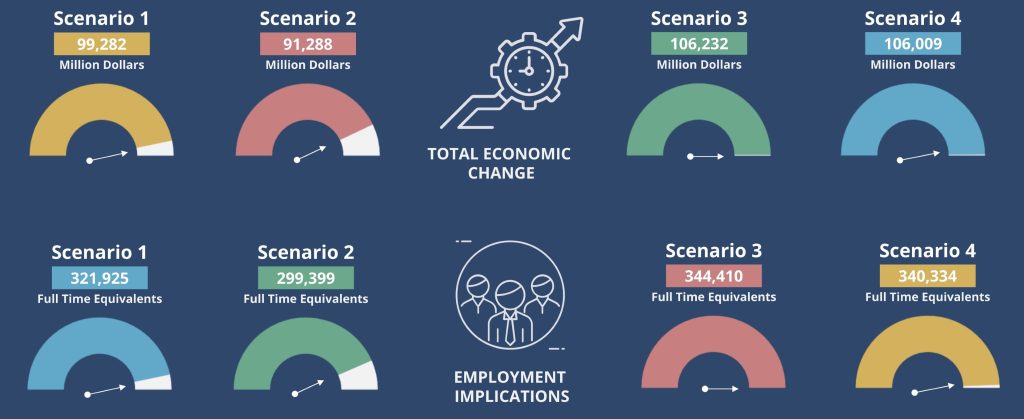

Economic impact

The worst economic impact comes from scenario two where precision fermentation to replicate dairy proteins takes off. Modelling suggests dairy production would fall with a 35% reduction in dairy area and this is not compensated for by an increase in arable returns. The NZ economy would be almost $8 billion worse off and there would be 22,584 fewer full-time equivalent jobs.

But scenarios three and four provide a boost to the economy of $6.9b and $6.7b respectively. They both result in a lift in full-time equivalent jobs with 22,486 more created by scenario two and 18,410 created by scenario four.

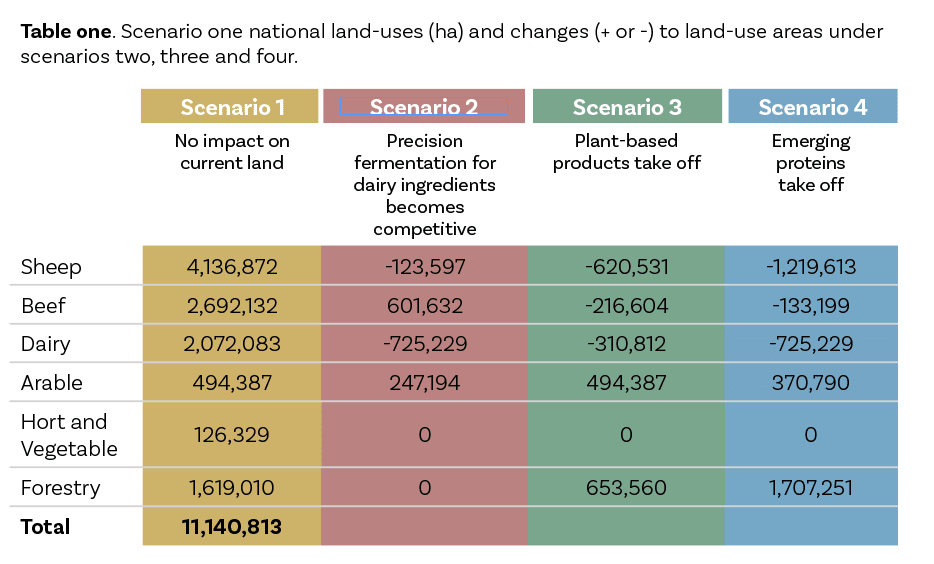

Land-use changes

Scenario four has a huge impact on the area of land where sheep are farmed with close to a 30% drop or 1.219m/ha while forestry more than doubles in area. The area under dairy also drops significantly (35%) for scenarios two and four. The area under arable production lifts for each scenario – doubling for scenario three where plant-based protein alternatives take off while precision fermentation and cell-based proteins don’t make such big gains.

Regional differences

Economic outlooks were developed for 16 regions with each facing different impacts for each scenario largely based on their abilities to grow arable and horticultural crops. The economic output for Canterbury and Hawke’s Bay for instance is improved under scenario four but declines for the West Coast, where dairy farming area decreases but fewer arable or horticultural gains can be made. Environmental impacts also vary. In Canterbury GHG emissions could fall by more than a third and nitrogen losses could drop by 15%, while in Hawke’s Bay the GHG emission reductions are not as great.

Forewarned means forearmed

The modelling is for outcomes in 2050. NZ and the primary sector have time to react to minimise the negatives and make the most of the opportunities.

Nature is a core strength and should be promoted as a point of difference for NZ primary produce. “Natural” meat and milk will appeal to a different market than those for highly processed protein alternatives.

But the sustainability of these “natural” products needs to be enhanced to counteract the arguments against them in favour of new proteins. That means agricultural GHG emissions need to be lower along with nutrient losses.

Māori knowledge of traditional fermentation practices is currently untapped and could offer opportunities.

Māori knowledge of traditional fermentation practices is currently untapped and could offer opportunities.

Serums and yeasts will be required for production of cell-cultured and precision fermentation produced proteins which could also offer opportunities for NZ as a supplier of the emerging “feed industry” to those sectors.

Alternative protein manufacturing processes require high energy inputs and NZ’s hydro and wind energy sources will be viewed favourably in terms of sustainability, but capacity needs to be sufficient.